While the statement “95% of people retire broke” may be a bit of an exaggeration, it is true that many people struggle financially during retirement.

Over the years, we’ve seen a lot of people doomed to financial failure simply because they failed to plan properly.

The sad fact of life, however, is that less than 5% of people will be financially free by the retirement age. Over 95% of the people will retire poor.

This begs the questions; Why do people retire poor? If you’ve read the book, “The Millionaire Next Door” by Tom Stanley and William Danko who highlight how two families, living in the same type of house and employed in the same job end up with totally different financial scenarios. By their late 40s, one is financially free. The other is deep in debt and despair.

What are your plans? Here are ten reasons that offer some answer.

1. Clearly Define “Financial Freedom”:

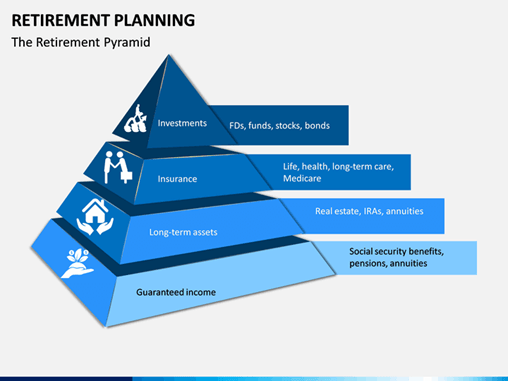

To attain financial freedom and avoid being poor at retirement, the passive income from your assets must be higher than or equal to the income you require in funding your chosen lifestyle. Most people retire poor simply because they have no clear definition of financial freedom or a concrete financial plan for their life.

2. Make Freedom an Absolute Must:

If you ask a hundred people how they intend to get rich, most will tell you they would love to win the lottery, marry an Heir (Heiress) or inherit a fortune. That mindset means most people don’t have retirement savings because they don’t have a plan. Sadly, hope is not a strategy, and to attain financial freedom and retire rich; you need to be relentless in pursuing your goals.

3. Know the Power of Your Subconscious Mind:

Ever come across the sentence, “rich people think like rich people and poor people think like poor people?” Your subconscious mind will set up your financial thermostat. Similar to a thermostat that controls the temperature of a room, your financial thermostat dictates your financial reality.

4. Surround Yourself with Rich People:

If you are serious about attaining financial freedom long-term, it’s essential to surround yourself with smart advisers to help with your retirement plan. There is a common saying that says, “birds of a feather flock together.” You can proactively begin today to choose to surround yourself with financially free people.

5. Confront the Brutal Facts of Your Financial Reality:

If you ask people about their financial status, most will tell you they don’t want to talk or think about it. To supercharge your pursuit of financial freedom, it is instructive to handle your finances yourself and confront the brutal truth about them. One of the surest ways to retire poor is to avoid facing the truth about your finances.

6. Save:

Many people will retire poor simply because they have no golden goose, and those that do frequently murder it in the name of immediate gratification. If there is ever a habit that everyone should adopt, it should be the habit of saving. Sadly, millions of people find one excuse or the other not to save. Without saving, your financial dreams might be in a faraway land.

7. Understand the Power of Compound Growth:

According to Albert Einstein “Compound growth is the eighth wonder of the world.” Compound interest can make or break you financially. It can make your life merry or miserable. Why? Compound interest can grow your wealth tremendously and increase your debt incredibly.

8. Have Your Money Work for You:

Robert Kiyosaki In his book “Retire Young Retire Rich,” suggests that earned income is the worst source of income for several reasons.

First, it’s the highest taxed income.

Second, you work hard for it, and it absorbs all your valuable free time.

Third, there is limited leverage in it in that the only way to earn more is to work longer and harder.

Finally, there is precious little residual value in this income in that each day you have to start afresh again. If you want to retire poor, keep working for money without an alternative source of income.

9. Have the Knowledge, Skills, and Coaching To Become Financially Free:

It’s said that knowledge is power. If that’s true, only a few are ready to pay the price to gain that knowledge. Poor people are the set of people with the worst reading habit. They find it challenging to invest in financial education.

10.Have a Plan, or the Will Power To Follow Through:

Great investors all have two things in common; they all had a plan, and they stick to it. It is imperative to have a plan for how you are going to attain financial freedom. Most people never map out a plan for their retirement, and the most significant percentage of those that do, do it too late. To avoid retiring poor, you need a plan early in your carrier, one that will take you to your financial destination.

Conclusion:

According to the Center for Retirement Research only 22% of workers in the United Sates are confident they’ll have enough money saved for retirement, while 45% of Americans have no retirement savings at all.

We encourage individuals to create a retirement plan that best fits their individual situation.

Contact and join us so you will have yet another chance today to choose the path you want to follow. You can easily create your retirement portfolio with us and we’ll even provide a means of earning so you reach your plan.

Review: How to become a millionaire: https://www.youtube.com/watch?v=qxLMWbjoGiM&t=1621s

Review: J.V. Cerney – How To Become A Millionaire: https://www.youtube.com/watch?v=YiXI7RqwtGQ

Live Long and Prosperously,

Reitenbach-Kissinger

Sydney Reitenbach and Michael Kissinger

Text: 650-515-7545

Email; mkskissinger@yaoo.com

Review: mksmasterkeycoaching.com