A Statistic that Shocks People is that: 73% of People Rely on only ONE Income Stream to Become Wealthy. They Stay Broke!

Creating multiple streams of income isn’t just a survival technique, it’s also a strategy for building wealth for ALL People.

Most self-made millionaires have multiple income streams:

- 29% of self-made millionaires had five or more streams of income.

- 65% of self-made millionaires had three streams of income.

- 45% of self-made millionaires had four streams of income.

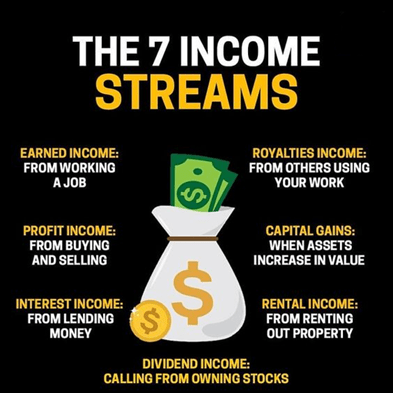

According to the IRS, Every Millionaire has a Unique Set of Assets. They All Fall into 7 Income Streams.

If you’re looking to build wealth and financial stability, diversifying your streams of income can be a powerful strategy. By generating multiple sources of revenue, you can reduce your reliance on any single income stream and increase your earning potential over time.

For the majority, that one income stream is their full-time job. And if you rely on one income stream, you run the biggest risk and never becoming wealthy.

Why?

Because you’re one bad day away from zero income streams. So what’s the solution? Creating multiple streams of income. And that’s exactly what you’ll discover in this message. Let’s dive in.

In this post, we’ll explore 7 different streams of income that can help you achieve financial independence and build long-term wealth. From passive income streams like real estate income and dividend stocks to more active income streams like entrepreneurship and royalties, there are a variety of ways to increase your earning potential and secure your financial future.

Whether you’re looking to supplement your current income or build a sustainable long-term wealth plan, these 7 streams of income can help you achieve your financial goals.

How to Create Multiple Streams of Income

Did you know the average millionaire has 7 income streams which include:

- Earned Income – Income from jobs/side hustles

- Interest Income – Income from savings accounts, bonds, etc.

- Business Income – Income from business profits

- Royalties – Royalties from books, inventions, etc.

- Dividend Income – Income from stock

- Capital Gains – Capital gains from selling highly appreciated assets

- Rental Income – Income from rents

How You can Create these 7 Income Streams.

If you’re looking to build wealth and financial stability, diversifying your streams of income can be a powerful strategy. By generating multiple sources of revenue, you can reduce your reliance on any single income stream and increase your earning potential over time.

In this blog post, we’ll explore 7 different streams of income that can help you achieve financial independence and build long-term wealth. From passive income streams like real estate income and dividend stocks to more active income streams like entrepreneurship and royalties, there are a variety of ways to increase your earning potential and secure your financial future.

So whether you’re looking to supplement your current income or build a sustainable long-term wealth plan, these 7 streams of income can help you achieve your financial goals. Let’s dig in.

1. Earned Income

Earned income is the most common and traditional form of income that most people receive through their employment. Earned income is the money you get in exchange for the time and effort that you put into your job. This stream of income is often characterized by a fixed hourly wage, annual salary, or commission-based pay.

One of the benefits of earned income is that it generally provides a consistent and reliable source of income that allows you to cover your basic living expenses and save for your future. This is also where most people start before building out other incomes streams in the future.

However, the downside of earned income is that your earning potential can be limited by your employer, your industry, and your time. In addition, though earned income is consistent for most people most of the time, there is lots of risk associated with relying on it as your only source of income. In the event that you lose your job, it can be stressful if you have no other source of income.

Nevertheless, if you want to maximize your earned income, you should focus on developing and improving your skills and expertise, networking with professionals in your industry, and pursuing career advancement opportunities. This may include getting additional education and certifications, seeking promotions or leadership positions, and/or even transitioning to a higher-paying job or industry.

Overall, earned income is where most of us start building out our income streams and an area that can’t be ignored if you want to start building wealth.

Earned Income Summary

- Pros: Reliable. Easier to obtain.

- Cons: Limited by time. Doesn’t scale. Can be risky as sole income source.

2. Interest Income

Interest income is another form of passive income that is generated by lending money to others, typically through a savings account, money market account, certificates of deposit, or fixed income securities. This form of income can be a reliable and predictable source of revenue, as the interest rate is typically fixed and earned over a set period of time.

One of the benefits of interest income is that it is generally considered a low-risk investment that provides a guaranteed rate of return. This makes it an attractive option for individuals who want to earn a steady stream of income without the volatility and risk of other investments.

To maximize your interest income, you can shop around for high-yield savings accounts or CDs that offer competitive interest rates. You can also consider investing in government or corporate bonds, which can provide higher interest rates than traditional savings accounts.

However, it’s important to recognize that interest income is subject to inflation risk. While prices may rise, your interest payments are fixed. And if the rate of inflation is higher than the interest rate you are being paid, then the purchasing power of your income will go down over time even if you are reinvesting that income.

Lastly, interest income is subject to income tax (sometimes at both the federal and state level), which can further reduce your earnings.

Overall, interest income can be a useful stream of income to supplement your other income sources as you continue to build your wealth. And with short-term Treasury rates hovering around 5%, there’s never been a better time in recent years to consider adding this income source to your portfolio.

Interest Income Summary

- Pros: Passive. Consistent and predictable.

- Cons: Requires capital. Small relative to other income sources.

3. Business Income

Business income is a form of earned income that is generated by owning and operating a business. This form of income can provide unlimited potential for revenue and can be a powerful tool for building wealth over time.

One of the benefits of business income is that it can provide flexibility and independence, as you are able to control your own schedule and make decisions that can directly impact your earnings. Additionally, owning a business can provide tax benefits, as certain expenses can be deducted from your income and reduce your overall tax liability.

To maximize your business income, you can invest in a business that has a strong potential for growth and profitability.

In particular, I’ve found that online businesses are great for getting started because costs are generally lower and margins can be quite high. You can also consider leveraging technology and social media to reach more customers and generate more revenue.

However, it’s important to recognize that owning a business can also come with risk, such as market fluctuations, competition, and operational costs. Additionally, running a business requires a certain level of time, effort, and investment that may not be suitable for you.

Overall, business income can be a useful stream of income for individuals who have a passion for entrepreneurship and the drive to succeed.

Business Income Summary

- Pros: Better tax treatment. Scales well (especially if the business is online).

- Cons: Requires lots of work, capital, or both. Can take many years before you see results.

4. Royalty Income

Royalty income is a form of passive income that is earned by owning and licensing intellectual property, such as patents, copyrights, or trademarks. This form of income can provide a steady and reliable source of revenue, as royalty income is typically earned on a regular basis, based on the usage or sales of the intellectual property.

One of the benefits of royalty income is that it can provide a consistent source of income without the need for ongoing maintenance or investment. Additionally, owning intellectual property can provide a level of protection and security, as it can prevent others from using or profiting from your creative works.

To maximize your royalty income, you can invest in intellectual property that has the potential for high demand and widespread usage, such as a popular song or book. You can also consider partnering with a licensing agency or publisher to handle the licensing and distribution of your intellectual property as well.

However, it’s important to recognize that royalty income is not without risk, as the demand and popularity of intellectual property can fluctuate over time. Additionally, the process of acquiring and maintaining intellectual property can be time-consuming and require a level of investment that may not always pan out.

Royalty Income Summary

- Pros: Passive. Scale very well.

- Cons: Requires a product with demand. No guarantee of a return on your time/effort/investment.

5. Rental Income

Rental income is one of the most popular income streams.

Why the popularity? Because real estate can provide a steady stream of cash flow from rents. Not only that but you can also:

- Get tax benefits

- Diversify your portfolio

- Profit from property appreciation

And it gets better: You don’t need $100,000s to start investing in real estate. In fact, you can earn rental income with as little as $10. Here’s how:

How to Earn Rental Income

Earning rental income is easy thanks to modern investment platforms. The best part about investing with Fundrise is that you can start with just $10.

Pro Tip:

Fundrise isn’t the only way to earn rental income.

You can also earn rental income from:

- Earn rental income and appreciation with farmland

- Earn rental income and appreciation with rental & vacation homes

Investing in real estate is a proven strategy to build wealth and earn passive income.

Make sure you do your research first before you commit financially.

6. Dividend Income

Dividend income is one of the best types of passive income.

You can earn dividend income by investing in dividend stocks.

With dividend stocks, you earn passive income from regular payouts from profitable companies.

And the more shares you own, the more dividends you earn.

With dividend stocks, you get:

- Tax advantages

- Capital appreciation

- A reliable source of passive income

And here’s the best part:

Companies typically increase their dividends during a recession to keep their investors (like you) happy.

But don’t fall for dividend traps, where stocks offer excessive dividends.

How to Earn Dividend Income

Ready to start earning dividend income?

Here’s the process:

- Open an investment account (if you don’t have one yet.

- Find top-rated dividend stocks (I use High Income Opportunities)

- Research your dividend stocks

- Decide how many shares to buy

- Diversify your portfolio

- Monitor and reinvest dividends

Investing in dividend stocks is one of the best ways to earn passive income.

Pro tip: If you want to get expert advice on dividend investing, consider joining us,

With High Dividend Opportunities, you can see your portfolio start producing high levels of income today, without having to wait a decade to really benefit you.

7. Capital Gains

Capital gains are one of the most powerful income streams.

What are capital gains? A capital gain is the profit earned from selling an asset for more than its original purchase price.

Now you might be wondering: “What assets go up in value so I can sell it later and make a profit?” Well, the good news is many assets appreciate in value.

And one of the highest-appreciating assets is fine art. In fact, the art market has outperformed the S&P 500 by 165% in the past 25 years.

The best part? You don’t need to be ultra-wealthy to invest in fine art anymore. Thanks to fractional investing, anyone can buy fractional shares of million-dollar artwork. While fine art investing can be extremely profitable, keep in mind that you will have to keep the money invested over a long timeframe (7+ years).

Do You Need All 7 Streams of Income?

While having multiple streams of income can be a great way to build wealth and achieve financial freedom, it’s important to recognize that you don’t need to have all 7 streams of income to build wealth. For example, I only have six of the 7 streams of income mentioned above (sorry rental properties) and that’s fine by me.

More importantly, having one big income stream can be more impactful than many small income streams. For example, earning a high salary or running a successful business can provide a significant source of income that can be used to invest in other income-producing assets in the future.

And for many people, this is the norm. By focusing on building a strong foundation, you can then leverage this income to build other income streams when the time is right.

Regardless of what you decide to do, finding the right income streams for your lifestyle and personality is far more important than having more of them.

Creating multiple income streams isn’t easy. But the short-term sacrifice is worth the long-term gains. Start today. Your bank account will thank me later. That’s all for now!

So, if you are ready to improve you wealth level, eliminate your Biggest Detriments to Your Wealth and Retire Early Contact and Join us in the MKS Master Key System Millionaire Program.

Live Long and Prosperously,

Reitenbach-Kissinger Institute

Sydney Reitenbach and Michael Kissinger

Text: 650-515-7545

Email: mjkkissinger@yahoo.com

FREE MKS Master Key System Multiple Streams of Income Coaching-Mentoring Programs to Make You Rich:

See: mksmasterkeycoaching.com

1. MKS Master Key Multiple Streams of Income Coaching System:

2. We will teach you how to get RICH in 1 HOUR

3. 10 Reasons Why Many Educated People Are POOR!

4. The 7 Levels Of Wealth (What Stage Are You In?)

5. 10 PROVEN STEPS to BUILD WEALTH from SCRATCH |Get RICH | Get out of POVERTY!

6. 12 Places Where Money Hides