“There is a science of getting rich, and it is an exact science, like algebra or arithmetic. There are certain laws which govern the process of acquiring riches, and once these laws are learned and obeyed by anyone, that person will get rich with mathematical certainty.”

This Science for Getting Rich has inspired countless individuals to achieve wealth and prosperity through the power of thought, will, and action. This enhanced coaching brings you even closer to these transformative principles with added insights and practical steps for achieving your financial goals and dreams.

This Science for Getting Rich has Three Major Components for RICHES:

[1]: SPIRITUAL PRINCIPLES

[2]: INTELLECTUAL PRINCIPLES

[3]: PHYSICAL PRINCIPLES

[1]: SPIRITUAL PRINCIPLES FOR GETTING RICH

Spiritual principles for getting rich often include practices like gratitude, generosity, setting goals, finding purpose, and detaching from an excessive desire for material possessions. Many spiritual traditions also emphasize financial principles such as challenging work, saving, avoiding debt, and living within your means, viewing wealth as a tool to be used wisely and not as the ultimate goal.

Cultivating abundance and mindset

- Gratitude: Appreciate what you have to cultivate a mindset of abundance rather than scarcity.

- Purpose: Find and commit to a divine or higher purpose, with prosperity being a natural outcome of living that purpose.

- Mindfulness: Be present and aware of your thoughts and actions, especially regarding money.

- Detachment: Avoid making the pursuit of money your highest goal and be willing to part with wealth as directed, not seeking security solely from it.

Financial practices

- Generosity: Give to others, such as through things, as a way to receive and to bless others.

- Challenging work: Be diligent and work hard, as many traditions believe God gives the “power to get wealth” through hard work and ability.

- Financial planning: Live on a margin, save money, avoid debt, and manage your finances carefully.

- Discernment: Differentiate between needs and wants and avoid debt which can presume upon the future.

Connection to the Divine

- God as the source: Recognize a higher power as the ultimate source of all wealth and provision.

- Honoring God with resources: Use your wealth to honor God, allowing blessings to flow through you to others.

- Faith and wisdom: Seek wisdom and have faith in a higher power’s guidance for your financial journey.

Spiritual Principles for Getting Rich

Spiritual principles for achieving wealth emphasize transformation of mindset and alignment of one’s actions with universal or divine laws.

Key principles include cultivating an abundance mindset, practicing gratitude, acting with generosity and purpose, and engaging in focused manifestation practices.

Core Spiritual Principles

- Abundance Mindset: True wealth begins with the conviction that resources are limitless, and you are worthy of prosperity. This involves eliminating subconscious “abundance blocks” and negative beliefs about money, such as “money is bad” or “I am not capable of thriving”.

- Gratitude: Regularly expressing genuine thanks for the blessings, you already have, no matter how small, is a cornerstone practice. This shifts your focus from a state of lack to appreciation, which is believed to attract more abundance into your life.

- Generosity and Circulation: The principle of “giving and receiving” is central to many traditions. Money is seen as energy that must flow, not be hoarded. Generously sharing your resources with others (through tithing, charity, or supporting your community) creates a positive cycle that allows wealth to return to you, often multiplied.

- Purpose and Calling: Aligning your financial pursuits with a deeper, divine purpose or passion ensures that wealth is a means to a greater end, not an end in itself. Wealth used to serve others or to make a positive contribution to the world has a redemptive quality.

- Faith and Trust: Having unwavering faith in a higher power (or the universe) to provide for your needs helps free you from the fear of loss and the anxiety that often surrounds money. This trust encourages you to take inspired action with confidence.

- Diligence and Aligned Action: Spiritual principles do not replace practical effort; they complement it. Hard work, integrity, and wise stewardship are consistently emphasized. The idea is to work diligently in alignment with your values and purpose, not merely for a paycheck.

- Visualization and Affirmation: Techniques like visualization (imagining you already have the wealth you desire) and affirmations (positive self-talk) are used to reprogram your subconscious mind and align your emotional state with your financial goals.

By integrating these spiritual principles with practical financial discipline (e.g., avoiding debt, saving, investing, setting clear goals), individuals aim for a holistic prosperity that enriches all aspects of life—spiritually, emotionally, relationally, and materially.

[2]: INTELLECTUAL PRINCIPLES FOR GETTING RICH

Intellectual principles for getting rich include mastering financial literacy, setting clear goals, living below your means, and persistently investing in both yourself and assets. Key concepts include creating multiple income streams, using leverage, controlling debt, and developing the mindset of continuous learning and discipline.

Monetary management and planning

- Live below your means: Spend less than you earn to create a surplus for savings and investment.

- Control debt: Avoid accumulating unnecessary debt and focus on paying down existing loans.

- Budget and save: Create a budget to track your spending and save consistently to build an emergency fund.

- Set clear financial goals: Establish specific, realistic goals to provide direction for your financial decisions.

Investment and Growth

- Invest in the long term: Give your investments sufficient time to grow and benefit from compounding.

- Diversify investments: Spread your money across different assets to manage risk.

- Create multiple income streams: Do not rely on a single source of income; develop side hustle or other ways to earn money.

- Making money works harder: Use leverage, like other people’s money or systems, to your advantage.

Mindset and Personal Development

- Cultivate financial literacy: Continuously learn about money management, investing, and the economy.

- Invest in yourself: Acquire new skills and knowledge to increase your earning potential.

- Be persistent and decisive: Do not give up when faced with challenges and avoid procrastination.

- Think differently: Do not compare your journey to others and avoid getting-rich-quick schemes.

- Surround yourself with the right people: Engage in a “master mind” group of talented and like-minded individuals.

Intellectual Principles for Getting Rich

“Intellectual principles for getting rich” refer to. specific mindsets, strategic planning, and consistent, disciplined application of financial and business knowledge. These principles go beyond simply earning money and involve a systematic approach to building and managing wealth over time.

Key intellectual principles include: Mindset and Personal Development

- Financial Literacy: Continuously educate yourself on personal finance, investment strategies, and economic trends. Understanding how money works is foundational.

- Long-Term Vision and Patience: Recognize that building substantial wealth is a marathon, not a sprint. The “magic of compound interest” works over decades, so patience and a long-term perspective are crucial.

- Strategic Decision-Making: Develop the ability to make informed decisions quickly. Indecision can be costly, and effective decision-making is a primary skill for seizing opportunities.

- Continuous Improvement (Kaizen): Embrace a mindset of constantly improving your skills, business plans, and financial strategies.

- Persistence and Grit: Be prepared to push through failures, rejection, and fatigue. Persistence and determination are considered “omnipotent” for achieving success.

- Focus and Intentionality: Direct your mental energy toward productive activities, problem-solving, and planning, rather than “wasteful leisure”. Where your focus goes, prosperity grows.

- Invest in Yourself: The most significant investment you can make is in developing new skills or perfecting existing ones. This increases your earning potential and value in the marketplace.

Strategic Financial Application

- Earn More Than You Spend: A fundamental principle is to live below your means and consistently save a portion of your income. It is not how much you make, but how much you keep that matters.

- Automate Savings: Make saving and investing automatic, right from your paycheck or bank account. This “set it and forget it” approach ensures consistency.

- Manage Debt Wisely: Focus on eliminating “bad debt” (especially high-interest credit card debt) as quickly as possible. Use debt as leverage for investments that generate income, not for lifestyle consumption.

- Take Calculated Risks: Avoid the riskiest strategy of all: avoiding risk entirely. Smart risks have “unbounded upside and limited downside”. This often involves investing in assets that fluctuate in value, such as stocks or real estate.

- Invest Your Savings: Do not let inflation erode your savings in a basic bank account. Put your money to work through shrewd, diversified investments to generate growth.

- Build Multiple Income Streams: Relying on a single source of income can be risky. Explore side hustles, business ventures, or other investments to diversify your income sources and fuel financial growth.

- Plan for Taxes: Develop a strategy to minimize taxes now and in retirement. An effective tax strategy can significantly impact the amount of wealth you accumulate and keep over time.

Practical Implementation

- Set SMART Goals: Define specific, measurable, achievable, relevant, and time-bound financial goals (e.g., “I will save $5,000 for an emergency fund in 10 months”).

- Seek Qualified Advice: Consult with a fiduciary financial advisor who is legally required to put your interests first, especially if you have a complex financial situation. You can find resources on financial planning through organizations like the Certified Financial Planner Board of Standards.

- Build Wealth, Don’t Just Look Rich: Focus on accumulating assets (investments, business equity, real estate) rather than luxury consumption (expensive cars, large homes with debt) that create ongoing liabilities.

[3]: PHYSICAL PRINCIPLES FOR GETTING RICH

There are no direct “physical principles” for getting rich, but there are connections between physical health and financial success through the shared principles of discipline, goal-setting, and long-term planning.

Financial principles like earning, saving, budgeting, and investing are the core components of wealth building, while the mindset of “physical wealth” (health) often enhances the ability to pursue these financial goals through increased discipline and energy.

Financial principles

- Earning: Actively seek ways to increase your income.

- Budgeting: Control spending and create a plan for your money.

- Saving: Save a portion of your income, live on the rest, and give some away.

- Investing: Make your money work for you, which often involves principles like compounding interest and investing in assets like real estate.

Psychological and Physical Principles

- Discipline and Goal Setting: Individuals who are disciplined in their physical fitness often apply the same discipline to their financial goals.

- Long-Term Planning: Both financial and physical wealth require a commitment to long-term planning and consistent effort, rather than seeking immediate results.

- Health as a Foundation: Maintaining physical health (physical wealth) provides energy and mental clarity to pursue financial goals effectively.

The “physical principles for getting rich” can be described as tangible actions and consistent behaviors that align with fundamental financial and psychological principles. These principles involve creating, managing, and leveraging resources effectively over time.

Key Principles for Building Wealth Include:

- Foundational Principles

- Value Creation: Wealth is directly proportional to the value you provide to the world. To generate significant wealth, develop in-demand skills and offer them to a large audience.

- Leverage: True wealth building involves leveraging systems, technology, or other people’s time to create a scalable system that works for you, rather than solely relying on your own labor.

- Direction Over Speed: Focus more on the consistent, long-term direction of your finances (e.g., investing in retirement) than on “get rich quick” schemes. Slow, steady progress in the right direction leads to better outcomes than fast, risky ventures.

- Delayed Gratification: Practicing self-regulation and self-control allows you to focus on long-term financial well-being rather than immediate desires, such as impulse purchases.

- Practical Application Principles

- Earn, Save, invest: The core mechanics of personal finance involve generating income, saving a portion of it, and then investing those savings so your capital can grow exponentially over time.

- Live Below Your Means: Meticulously track all expenses and reduce unnecessary costs to increase the amount of money available for saving and investing. As the saying goes, “a small leak will sink a great ship”.

- Invest Intentionally: Put your savings into assets that generate returns (e.g., real estate, stocks, a business). Reinvesting gains accelerates the wealth-building process.

- Acquire Financial Knowledge: Continuously educate yourself on financial matters. Understanding how money works and staying informed on market trends is crucial for making sound decisions.

- Take Calculated Risks: Focus on “good risks” which have limited downside but unbounded upside (e.g., starting a business or learning a new skill).

- Consistency and Discipline: Achieving financial success requires consistent, disciplined habits over an extended period. Like physical fitness, financial fitness is about establishing good routines early and sticking with them.

By aligning actions with these enduring principles, individuals can create a robust framework for generating and sustaining wealth.

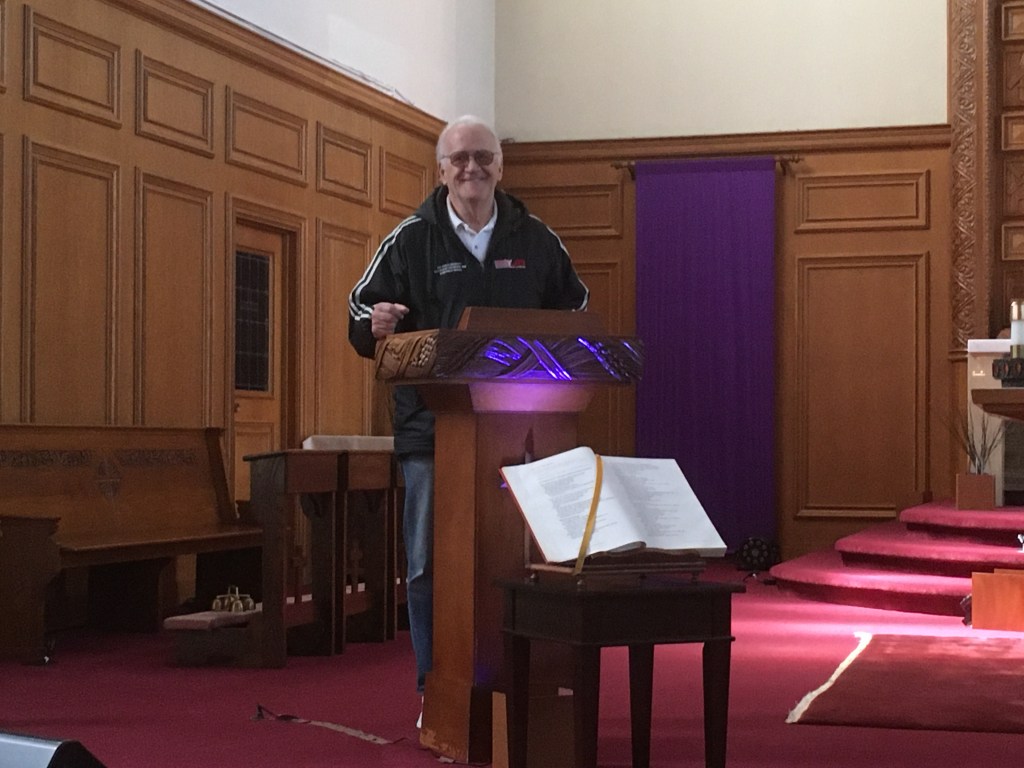

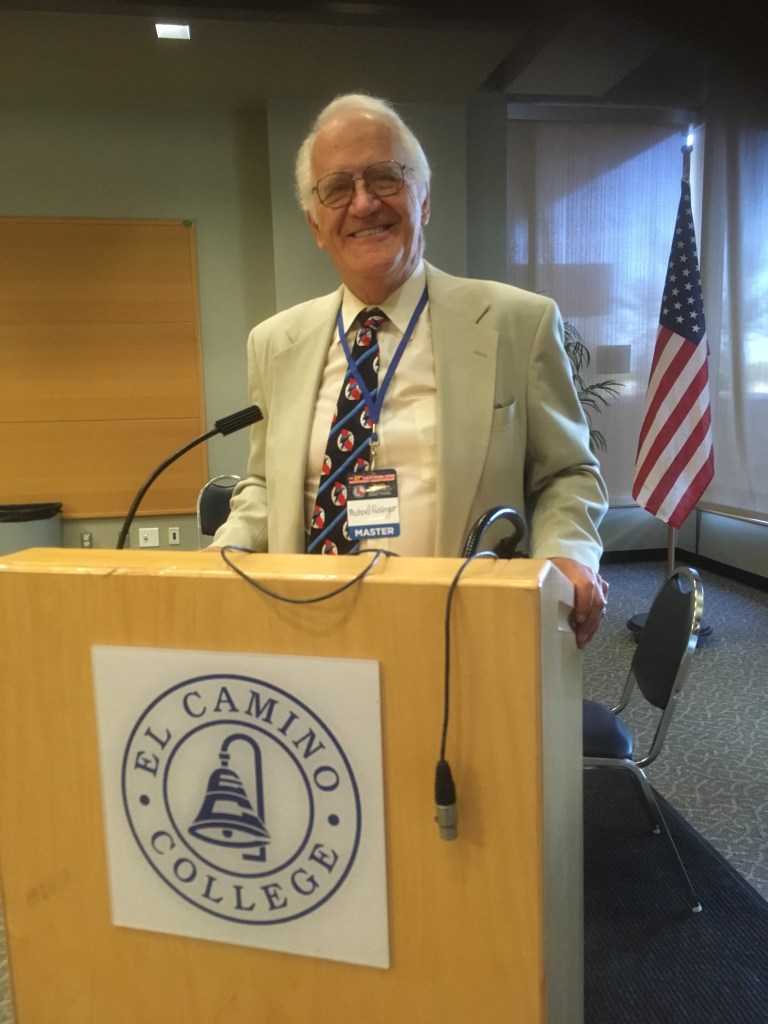

Overview of Michael Kissinger’s Interpretation

A renowned motivational speaker and author, has dedicated over forty years to studying the principles of wealth and success.

His interpretation of “The Science of Getting Rich,” originally written by Wallace D. Wattles, simplifies complex concepts into actionable insights. He asserts that getting rich is an exact science, governed by universal laws that, when understood and applied, make wealth a mathematical certainty.

Key Principles

- Belief in Abundance: He emphasizes the importance of believing that you can attract anything you desire in life. This foundational belief is crucial for manifesting wealth and success.

- Defining Your Purpose: He encourages individuals to ask themselves what they want and to discover their purpose. This clarity is essential for applying the principles of wealth creation effectively.

- Practical Application: He provides practical ways to implement the concepts from “The Science of Getting Rich” into daily life, helping individuals to overcome obstacles and achieve their financial goals.

- Mindset and Paradigms: Understanding and shifting your mindset and paradigms is vital for breaking free from limiting beliefs that hinder financial success.

- “The Science of Getting Rich” emphasizes that wealth creation is governed by specific laws, and understanding these laws can lead to financial success.

Science of Getting Rich Coaching

“The Science of Getting Rich” refers to the classic book by Wallace D. Wattles, which has influenced many well-known mindsets, success, and prosperity coaches. The book is a foundational text in the New Thought movement and modern self-help genres.

Michael Kissinger has been heavily influenced by the book’s principles:

- Michael Kissinger (Reitenbach-Kissinger Institute): A prominent wealthy and successful coach who studied Wattles’ principles for decades and developed entire seminars and programs around them. The Reitenbach-Kissinger Institute offers comprehensive programs on the topic.

- Michael Kissinger is an award-winning entrepreneur and educator who provides coaching on money management and entrepreneurship and offers a course on “The Science of Getting Rich.”

- Michael Kissinger: The CEO of the Reitenbach-Kissinger Institute and a Minister with over 20 years’ experience coach and University Professor at 3 California Universities discusses and coaches on the principles of the book through various channels.

MKS Master Key Coaching-Law and Engineering focuses on the philosophical and mindset aspects of wealth creation, such as positive thinking, vision, gratitude, and focused action, rather than specific investment strategies or traditional financial advice, which are typically handled by certified financial advisors.

We individuals who teach principles from Wallace D. Wattles’ book, often through programs, workshops, and coaching sessions focused on mindset, positive thinking, and consistent action to achieve financial success and personal fulfillment. We emphasize creating wealth through a “thinking into results” approach, using concepts like gratitude, focusing on creation rather than competition, and holding a vision of already having what you desire.

Common Principles and Approaches

- Mindset and positive thinking: We emphasize changing one’s mindset from one of lack to one of abundance, believing that “thinking into results” is key to success.

- Vision and gratitude: Our core practice is to create an unclouded vision of what you want and to regularly give thanks for it as if you already have it.

- Creation over competition: Our philosophy encourages focusing on creating value rather than competing with others, based on the belief that there is enough for everyone.

- Consistent action: We stress the importance of daily, consistent action aligned with your vision, which they see as a key part of the “science” of getting rich.

- Personal development: Our focus is often on becoming the “highest and best version of yourself,” which includes improving yourself and having a positive impact.

Important Considerations

- Critics sometimes describe the book’s methods as a “power of positive thinking” approach rather than legitimate financial or investment strategies, notes Wikipedia.

- We reject “get-rich-quick” schemes and expect commitment to challenging work and self-improvement from their students.

What to Expect from a “Science of Getting Rich” Coaching

Our Coaching typically focuses on:

- Mindset and manifestation: Emphasizing the power of positive thinking and aligning one’s self-image with success.

- Vision and purpose: Guiding clients to define what they want from life to motivate extra effort.

- “Efficient action”: Focusing on doing a few things extremely well and adding high value to others.

- Universal laws: Teaching that working in harmony with certain universal principles will lead predictably to riches.

It is important to note that the content of “The Science of Getting Rich” is commonly regarded as pseudoscientific in nature and focuses on a philosophical approach rather than specific, regulated financial investment advice. Individuals seeking specific investment strategies should consult certified financial advisors.

THE SCIENCE FOR GETTING RICH Wallace d Wattles https://www.youtube.com/watch?v=epqr2LszCUk&t=2s

Wallace D. Wattles: The Universe DEMANDS You Be Rich (The Hidden Law of ‘Increase’) 1:19:42 Now playing

Wallace D. Wattles: The Law of ‘Mental Form’ (Your Riches Already Exist in This Dimension) 1:50:07 Now playing

Wallace Wattles: The ONE Law That Turns ‘Thinking Stuff’ Into Cold, Hard Cash 1:36:45 Now playing

Hill vs. Wattles: The Ultimate Battle for the Secret to Wealth (WHO WAS RIGHT?) 1:48:48 Now playing

Wallace Wattles: Gratitude is a SECRET WEAPON (Not Just a Feeling)

Wallace Wattles: The Law That FORBIDS You to Fail (The Secret of the ‘Certain Way’) 1:27:14 Now playing

Wallace Wattles: Sickness is an ILLUSION (Here’s How to Restore Your Natural Health) 1:28:47 Now playing

Wallace Wattles’ Secret of the ‘Thinking Stuff’: The ONE Substance That Creates All Wealth 1:27:24 Now playing

Wallace Wattles’ Method to ESCAPE ‘The Waiting Place’ & Trigger Your Desires 1:26:18 Now playing

Wallace Wattles: The ONE Feeling That FORCES Creation (This is the Master Key) 1:13:51 Now playing

Need Help to Become Rich?

Contact us for MKS Master Key Financial Coaching to create a Plan and apply proven strategies to help you get and prosper so you recognize, seize more opportunities, and build wealth through strategic activities, underpinned by disciplined habits.

Reitenbach-Kissinger Institute

Sydney Reitenbach

Michael Kissinger

Text: 650-515-7545

Email: mjkkissinger@yahoo.com

LinkedIn: https://lnkd.in/gE7s99mP

See: MKS Master Key Coaching: mksmasterkeycoaching.com