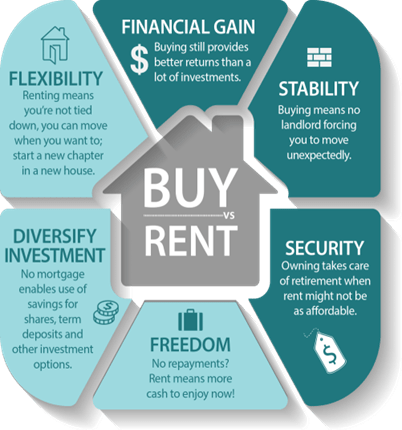

What You Are Seek is Seeking You… Happiness, Appreciation, Equity, Tax Savings, Roots, Education, Freedom, Security, Stability, Financial Gain, Flexability, Diversity and Ownership

Buying a home is probably the biggest purchase most of us will make in our lifetimes. A homebuyer would need to earn nearly $200,000 annually to afford a $1 million mortgage. It’s perfectly natural to have questions and experience every known emotion during the home buying process.

There’s a lot of work to do, but don’t worry — this home buying checklist will help you roll up your sleeves and get you ready for your closing date in these easy steps.

The steps to buying a house might seem complicated—particularly if you’re a homebuyer trying to purchase real estate with no prior experience.

Between down payments, credit scores, mortgage rates (both fixed-rate and adjustable-rate), property taxes, interest rates, and closing the deal, it’s easy to feel overwhelmed. There’s so much at stake!

Still, if you familiarize yourself with how to buy a house beforehand, it can help you navigate the real estate market with ease. So let’s get started with what to know about buying a house for the first time!

Some Reasons Why You Should Buy A Home

1. Happiness

The feeling of owning your own home is unmatched. You can fix it up, make it your own, paint it, get a dog or three, plant a tree or take one down if you want. Doesn’t that sound exciting.

2. Appreciation

Home values have a well documented trend of going up over time. This increase becomes equity you can benefit from when you refinance or sell

3. Equity

Renting has often been compared to paying 100% interest, but when you own a home and a mortgage is in place, a portion of your payment goes toward the principle balance on your loan. This builds your equity and acts a savings account.

4. Tax Savings

The government rewards home owners by providing excellent tax incentives. The interest paid on your mortgage and other home-related expenses can generally be deducted from your income.

In 2017, the Tax Cuts and Jobs Act (TCJA) was signed into law, and with it many changes to the types of deductions homeowners can take advantage of.

Homeowners can still benefit from the mortgage interest deduction, although it is now capped and homeowners get to enjoy the exemptions to the capital gains tax when they sell their primary residence. (Be sure to speak to your accountant and/or a 1031 exchange attorney before making any final decisions)

5. Roots

People who own rather than rent stay in their homes 4 times longer. This provides an opportunity to get to know your neighbors and connect with your local community.

6. Education

Research shows that children of home owners earn higher test scores and graduate at a higher percentage than those of renters.

Complete Home Buying Checklist

Use this home buying checklist as a cheat sheet for your entire home buying process: from gathering your documents to applying for a mortgage and finding your dream home. We explain each stage of the process in detail below.

Step 1: Start Saving a Down Payment

Saving to buy a house requires more than just saving for a down payment. A $1 million home might be a dream home in many neighborhoods, but that’s not the case everywhere—particularly for borrowers wondering how large of a mortgage they can qualify for and what kind of interest rate they can get.

According to Zillow’s data from February 2024, a typical home is valued at over $1 million in 550 cities across the country. Most of those (210) are in California—where mid-tier homes go for around $775,000 on average. But many are also in New York, New Jersey, Florida, and Massachusetts.

Nationwide, average home prices have oscillated around the $500,000 mark for the last few years, so a $1 million budget might get you a lot more than a mid-tier home in many areas. But no matter where you’re buying, high mortgage rates can make a $1 million home an especially difficult purchase.

Consider How Much Income Do I Need to Afford a House

Assuming you’re getting a mortgage, your income will only be one of the factors that lenders consider. If you have excellent credit, lots of savings, and don’t have any other debts, you might be able to buy a $1 million home if your gross (pre-tax) annual household income is around $150,000 or higher. However, this hypothetical assumes you put 20% down, get a 6.75% interest rate on a 30-year fixed-rate loan, and can qualify and are comfortable with a debt-to-income (DTI) ratio of 50%.

A 36% DTI is a more reasonable and realistic level. If you keep all the other factors the same, your gross annual income would need to be around $210,000 to buy a $1 million home. Or, if you want to stay within the recommended 26% ratio, you’d have to earn about $290,000 or more.

Consider What Affects a Mortgage’s Income Requirements

Lenders don’t consider your income in isolation. Many factors can affect your eligibility, interest rates, and borrowing limit. And the factors are often interdependent. For example, your income requirement could depend on the maximum DTI you can qualify for, and the maximum DTI might depend on your credit score.

Consider these Common Factors that Lenders Consider When Purchasing a New Home

- Debt-to-income (DTI ratio): A comparison of your monthly income and debt payments. The more debt you have—housing or otherwise—the higher your income will need to be.

- Down payment: The less you put down, the more you have to borrow, which affects your DTI. If you put less than 20% down, you may also need to pay for private mortgage insurance (PMI), which will increase your monthly housing costs.

- Credit scores: Your credit scores can affect your eligibility, interest rate, maximum DTI, and required down payment. A higher credit score can help you qualify for a loan with a lower interest rate and less stringent requirements.

- Interest rate: The loan’s interest rate will impact your monthly payment, which affects your DTI. A lower interest rate will lead to lower housing costs, which means you’ll need less income to qualify.

- Savings and investments: Lenders may consider how much money you have in savings, investments, and retirement accounts. Large loans may require you to have six to 12 months’ worth of liquid assets, although the amount might depend on your down payment, credit score, and whether you’re buying a primary residence or second home.

Potential Risks of Buying a House

A $1 million house is a major purchase, and it can come with some direct risks and potentially hidden costs:

- You could wind up house poor: You might find yourself living in a wonderful home, but your housing expenses could eat up most of your monthly budget. As a result, you won’t have much left over to build your savings, cover emergencies, or have fun.

- There may be percentage-based expenses: There may be closing costs that are based on a percentage of the sale amount, such as transfer taxes and mortgage origination fees. Some ongoing costs, such as property taxes, can also depend on the home’s value. And your home insurance costs may also depend, in part, on how much it would cost to repair or rebuild your home.

- You might have high maintenance costs: The ongoing maintenance for a $1 million home may be much higher than what you’d have to spend on a lower-cost home. Although, the costs also depend on where you live and home’s age and condition.

You may also find your day-to-day living expenses start to creep up if the home is located in an affluent neighborhood.

Other Considerations to Consider When Buying a Home

Figure out the amount you can comfortably afford to spend on a house to estimate how much you need to save. It’s generally advised to save up to 25% of a house’s purchase price in cash to cover upfront costs associated with buying a home. This will include*:

Down payment: expect to need about 3-20% of the purchase price saved to cover the cost of a down payment.

Closing costs: try to save about 2-5% of the purchase price to cover closing costs.

Moving expenses: The average cost of moving a household is about $1,250 or $4,890 if moving long distance.

Step 2: Consider the Seven Ways to Save Money to Buy a House

You’ll need to think about factors, such as closing costs and moving expenses, to name a few. If you’re worried whether you’ll be able to set aside enough — putting down 20% is ideal — you’re not alone.

1. Open a high-interest savings account

2. Automate your savings

3. Reduce your monthly expenses

4. Pay down your debt

5. Earn additional income

6. Track your savings progress

7. Start a Small Business or Create Multiple Streams of Income

Step 3: Consider Checking Your Credit Score

A favorable credit score to buy a house is typically in the high 600s and 700s. Anything higher than that is considered “exceptional”, and helps borrowers get the very best mortgage rates. Certain loan types even allow you to buy a house with a credit score as low as 500. Where do you stand?

Step 4. Buy a Home You Can Easily Afford

A lot of people buy homes at the top of their range, and that’s a huge mistake for most…never be a paycheck away from foreclosure or struggling.

Step 5. Consider a House with Bad Aesthetics and Fantastic “Bones.”

Buy the house that looks decent on the outside but has internal superficial ugliness – gross paint, carpets, etc.. As long as the major systems are fantastic (plumbing, electrical, roofing, etc..), superficial things can be fixed and will add instant value. Buy the crappiest house in the nicest neighborhood you can. It will always sell for more than what you paid for it, if you put in some elbow grease.

Step 6. Consider Getting to Know Your Market

Go on line and see what houses have sold for in your area, before making an offer…know how competitive the market is, so you know how competitively to bid – how long do homes stay on the market? We’ve offered prices $100K less than ask and gotten homes, but we also bought homes by offering the asking price.

Step 7. Look at the Crime Map for the Area

There are beautiful cheap homes out there in neighborhoods you’d never want to live in. Don’t be suckered in to crime areas.

Step 8. Don’t Ever Buy Anything With an HOA

You can never get rid of it, it can go up, and you can never truly pay off your property.

Step 9. Consider Additional Income Streams to Pay Mortgage

Does it have an in-law apartment or space you could rent out or use for Air BnB? Could you rent out a room or two if you were in a jam? Should you create multiple streams of income to pay it off.

Step 10: Get Pre-Approved for the Mortgage

Get Pre-Approved to gain an advantage over other buyers, improve your closing time, and get the confidence you need to shop around for the house of your dreams – even when there’s a historic shortage of homes for sale.

Mortgage pre-approval is a process that aims to make the home-buying process easier. Getting pre-approved by a lender for a mortgage loan means that after taking a slightly more shallow glance at your financial situation, you seem to be in a position to get your future mortgage application approved.

Proof of pre-approval may come as a letter from mortgage lenders like (they call it a VAL – Verified Approval Letter). This often helps home-shoppers when they are bidding on a home- showing readiness to buy and a sign that there may be fewer than otherwise expected road bumps along the way.

Step 11. Know the Benefit of a Mortgage Pre-Approval

Getting a home loan pre-approval gives the borrower a competitive advantage with a mortgage loan pre-approval by showing the house seller your readiness to purchase.

Additionally, upon pre-approval, you get an idea of the terms of the loan you can receive (i.e. loan amount and interest rates), which can save you time and effort by avoiding shopping for not relevant homes and applying for a mortgage you may not receive.

In order to get pre-approved, the mortgage lender you apply for a pre-approval with will have to review the following factors from your financial situation:

DTI (debt-to-income) ratio

* LTV (loan-to-value) ratio

* Credit history

* Credit score

* Income

* Employment history

Step 12: Know What’s Required for Loan Pre-Approval

To get preapproved for a mortgage, make sure you have the following documentation ready:

* 30 days of pay stubs

* 60 days of bank statements

* W-2 tax returns from the previous two years

* Schedule K1 (Form 1065) for self-employed borrowers

* Income tax returns

* Asset account statements (retirement savings, stocks, bonds, mutual funds, etc.)

* Driver’s license or United States passport

* Divorce papers (if applicable)

* Gift letter (if a family member is making a contribution to your down payment)

Be sure to get a “fixed” interest rate with your mortgage…and have great credit. No matter what happens in the market, you’ll be grateful.

Have enough money down that you will not be paying PMI (mortgage insurance)…this can be hundreds a month that doesn’t even go toward your balance. Your payment per month will be far lower.

Are Pre-Qualification and Pre-Approval the Same Thing?

Another option for getting an idea of approximately how much money you qualify to borrow from a lender and at what terms would be a pre-qualification. This isn’t something that a home-seller would really benefit from seeing.

Getting pre-qualified is one stage before applying for a pre-approval and is an estimate based on information the borrower provides to the lender. These estimates are subject to change, as the foundation of the estimate is not based on the review of any financial documents or confirmation of the borrower’s financial situation. Unlike most pre-approvals, getting pre-qualified does not require a hard credit pull.

Step 13: Find an Honest Real Estate Agent You Can Work With

Buying a home can be a complicated and confusing process, even for seasoned home buyers. That’s why nearly nine out of 10 buyers work with a professional real estate agent at some point during their home purchase process. Research. Here’s how to hire a buyer’s agent — and why it’s usually a good idea.

Step 14: Consider Shopping a Home with these 15 Considerations in Mind!

1. Make sure you’re ready

2. Get your finances in order

3. Make a plan for the down payment

4. Create a wish list

5. Find the right mortgage for you

6. Get preapproved for a mortgage

7. Find a real estate agent

8. Go shopping!

9. Make an offer

10. Get a mortgage

11. Get homeowners insurance

12. Schedule a home inspection

13. Have the home appraised

14. Negotiate any repairs or credits with the seller

15. Close on your new home

Don’t be “wowed” or turned off by the appearance going in. They hire professional staging companies for a reason…to make the house more appealing. They also have trouble sometimes selling great homes because hoarders or messy people live there. Look beyond the grit, or beyond the flash.

Step 15: Considerations for Making an Offer

1. Make sure your financing and cash are all set

2. Determine how your buyer’s agent gets paid

3. Set an offer price

4. Decide how much earnest money to offer

5. Choose the contingencies to include

6. Write a purchase offer

7. Walk away, negotiate or move toward closing

8. Ready to make an offer on a house?

Step 16: Consider Getting a Home Inspection

When considering a home inspection before purchasing a house, keep the following key factors in mind:

1. Structural Integrity:

Check for cracks in walls, ceilings, and foundations.

Roof Condition: Inspect for missing shingles, leaks, or signs of wear.

Plumbing System: Look for leaks, water pressure issues, and pipe conditions.

Electrical System: Ensure wiring is up to code and check for overloaded circuits.

HVAC Systems: Test heating and cooling systems for functionality and maintenance history.

2. Pest Infestation: Look for signs of termites or other pests that could cause damage.

3. Insulation and Ventilation: Assess insulation levels in attics and crawl spaces for energy efficiency.

4. Windows and Doors: Check for proper sealing, functionality, and signs of rot or damage.

5. Appliances: Verify the condition and age of included appliances.

6. Safety Features: Ensure smoke detectors, carbon monoxide detectors, and fire exits are in place and functional.

Addressing these issues early on in the home buying process is key to saving you money down the road. Additionally, inspections can give you an upper hand when negotiating a sale

Step 17: Consider Getting a Home Appraisal

What home appraisers look for is the question everyone wants to know since it is such an important part of the home buying process. It is:

1.The General Condition of the Home

2. The Home’s Location

3. The Age of the Home

4. The Home’s Exterior

5. Design of the home

6. Signs of water damage

7. Size of the home

8. Home’s Interior

9. Home Improvements

10. Signs of Infestation

11. Safety features

Step 18: Consider Heading into Closing

The closing process takes several weeks as you navigate through multiple steps to make it to the closing table. Closing on a house is the most rewarding part of the home buying experience. And hopefully, you’ll walk into your closing day with all your questions answered, negotiations settled and your mortgage preapproved. On this day, you should also be ready to become the legal owner of a home.

Step 19: Consider Doing these Move In Actons Immediately After Purchase

1. Connect the utilities

2. Secure your home

3. Check smoke and carbon monoxide detectors

4. Purchase or review your home warranty

5. Find the circuit box, emergency shut-offs and appliance manuals

6. Refresh the paint and flooring

7. Use your inspection report as a to-do list for upkeep

8. Create a regular maintenance schedule

These Are a Few Consideration a New Home Buyer Should Make

Contact us if you would like help in buying your next home. We’ll help you to make your buying decision and purchase successful.

Live Long and Prosperously,

Reitenbach-Kissinger Institute

Sydney Reitenbach and Michael Kisssinger

Text: 650-515-7545

Email: mjkkissinger@yahoo.com

See: mksmasterkeycoaching.com

By: Michael Kissinger Helped Over 5000+ Businesses Generate $1 Billion Offering Result Only Coaching: Exceptional Profit Results-Proven Strategies and Universal Law Skills Every Business Owner Wants to Achieve Their Essential Transformation

Activate to view larger image,