Eliminate the Challenges Preventing You From Becoming a 7 Figure Lawyer After Law School and Beyond

Ready to Turn Your Annual Income Into 7 Figures and Retire from Your Practice? Be Financially Free and Enjoy the Freedoms You and Your Family Work For Every Day!

Follow These Easy and Simple Steps and You’ll Be on the Road to Becoming a 7 Figure Millionaire Lawyer!

It’s no surprise when laid-off lawyers or law school grads who can’t find a job hang out their own shingles, but there are even more attorneys heeding the siren call to start up their own firm in order to achieve a better work-life balance (if that even exists). You may feel at times that starting a law firm is counterintuitive when it comes to finding balance in your life.

However, if you build it right, running your own firm can be a highly satisfying way to employ yourself and serve clients the way you’ve always wanted. It can also lead to a 7-figure income.

Lawyers in the US earn a median annual wage of nearly $136,000. Although they are not among the twenty highest-paying occupations, they still earn well above the median income of $60,070. Review: https://usafacts.org/articles/how-much-money-do-lawyers-make/ Published Thu, February 29, 2024 by the USAFacts Team

What’s Your Plan to Become a 7 Figure Earner or Millionaire Investor?

Surprisingly, the average lawyer isn’t a millionaire, at least not before their later years. Does this mean that you can’t be wealthy as a lawyer? No. It just means that being a lawyer doesn’t automatically equal wealth.

Having a high income, like being a lawyer, is great. It means that you can save money faster and possibly retire earlier. However, income and wealth are two entirely different things.

Will You Become a 7 Figure Lawyer with Your Salary or a Millionaire through Investments or Both?

There is no reason why as a lawyer you couldn’t be a 7 Figure Lawyer and a millionaire through investments build your wealth. However, it all depends fully on your financial literacy.

Do You View the Law as a Business Rather than a Job?

While working with successful and rich lawyers we had a chance to observe how they made millions. One common trait among them was that they usually were leading their own law firms as partners and were astute entrepreneurs. They viewed the law as a business rather than a job.

They looked at how they could serve a maximum number of paying clients in the most efficient way. All of them automated and standardized their business, essentially providing similar or analogous services to multiple clients. A famous example is LegalZoom.

To become a 7 Figure Lawyer rather than an Investor you would have to jump all the necessary hoops, from going to law school, gaining experience at a good law firm, and opening their own legal business.

Eight Ways to Become a 7 Figure Lawyer

How you can become a 7 Figure Lawyer is a different and a simple process. Most lawyers never get there because they lack excitement in what they do and fail to follow personal finance principles to make investments.

- 7 Figure Earner through a Successful Partnership

So, how do lawyers become 7 Figure Lawyers by practicing law?

Most lawyers make good money through legal work.

Most lawyers start either as associates or then rise into partnership ranks. Or they open their law firm from the start. Path to partnership is harder in existing law firm than if lawyer opens own law firm.

Partners in successful law firms usually make most of the money, as they are shareholders of the legal business. They share most of the profit, and they make all big decisions collectively and share losses and expenses.

Partners in large Big Law firms can charge anywhere from $500 to several thousand dollars per hour. Big Law usually includes top 100 law firms in the US. Large law firms have many associate (non-partners) attorneys who are workhorses. They bill many hours of legal work without sharing profits.

Usually, they are required to bill 1800-2000 hours per year. That’s a lot. Because much of the hours are preparatory or administrative and cannot be billed to clients. Therefore, young associates rarely make millions even in big law firms.

A partnership is a primary way for a lawyer to get rich and become a 7 Figure Lawyer. But it is extremely hard to become a partner in a large firm.

Partners in smaller law firms make various incomes. It depends on how successful they are in business marketing promoting their business. And local market plays a major role. Big city small law firms usually make more money.

2. 7 Figure Earner By Graduating from a Top Law School

Law school rank helps to start a legal career on a higher level and with higher pay. Young lawyers from top law schools can easily make six figures right after passing the bar exam. They usually work for big law firms which have big net worth clients.

These lawyers have insanely difficult work schedules, but in the first 3-5 years they can repay student debt and even save some solid money. Such young lawyers form top law schools could gross a million dollars in their first 6-8 years of work. But often in 3-5 years they leave the large firm to start working elsewhere.

Sometimes they work for other law firms, open their firms, or leave the law profession to go into business or media.

Still, those young lawyers from top law schools can make millions of dollars as lawyers with their law firms. Because they have very good credentials after graduating from top law school and working in a top law firm brings good salary. The network obtained in top law school is also important.

Going to top law school is probably the fastest path for a lawyer to become a millionaire and a 7 Figure Lawyer

3. 7 Figure Earner Graduating from a Lower-Ranked School

I have met a few rich lawyers who made millions without attending top law school. They were entrepreneurial and made the best effort to learn as much as possible and grow their careers and law business. That includes some of my former classmates.

Such lawyers became rich millionaires because they were very active, made friends and connections, obtained their regular clients and served them well. They established a good reputation and worked very hard and smart.

The ability to network, obtain and retain clients is the key there. I have law school acquaintances who opened their law firms solo or with other attorneys right after passing the bar exam. They advertised like hell and at least a few of them now have established a very solid law practice. A couple of those lawyers are most definitely millionaires. They will get even richer as their career and businesses grow.

But best way is to work for experienced lawyer first and learn the job before branching out.

In summary, lawyers can get rich and become 7 Figure Earners even if they went to lower-ranking schools. But it is easier for a lawyer to become a millionaire and 7 Figure Earner in law practice after higher-ranked law school. .

4. 7 Figure Earner Working in a Successful Law Practice

For example, average successful lawyers can charge anywhere from $120 to $350 per hour once they get sufficient legal work experience. Usually, it takes a decade or so of legal work to get there but not always.

So, they hire younger law associates, pay them a percentage of hourly fees. With a large volume of work that difference can make a lawyer a multi-millionaire in 5-10 years.

Many lawyers charging flat fees for a specific work which is usually known to take a certain amount of time.

For example, lawyers registering a corporation or LLC (a company) usually charge a flat fee of $500-$5000 or more. Depending on how it is complicated. Well-defined services like selling a house, and so on are usually charged on basis of a flat fee.

Some lawyers charge monthly membership fees for their clients. We know about small business lawyer who charged more than a thousand dollars monthly fee for each business client.

He maintained their legal issues to makes sure things do not get wrong. He was making anywhere from $700 thousand to a million dollars per year in gross earnings from his home office.

Foreclosure law firms, for example, charge clients $400 to $800 dollars or more each month they can delay foreclosure. Sometimes they keep people in their homes for 2-5 years and get paid every month.

Litigation is usually unpredictable and civil litigation lawyers charge either hourly or based on outcome (contingency fee).

The richest attorneys are those who do high-level mass litigation against large companies. Those lawyers can become millionaires and 7 Figure Earners after one winning large-scale case.

5. 7 Figure Earner Going into Your Own Business

Sometimes lawyers go into business with ex-clients or with new partners. Or, even solo. We have seen lawyers purchasing or opening service businesses. Some lawyers succeed and get rich in business, some do not.

The safer way for a lawyer to make millions in business is to become a top manager in a large existing business and get profit-sharing. They are hired if they bring solid legal expertise with them. Lawyers can either start working in-house (in a legal department of the business company) and rise through the corporate ranks.

6. 7 Figure Earner Making Business Deals

Lawyers can make business or media deals and essentially get rich and become 7 Figure Earners with that. Lawyers could write a book or get a radio show. Or even show on TV. Now with online media, this process may be even easier. Lawyers can become media persons and make money by either being show hosts, podcasters, and so on.

7. 7 Figure Earner Making Wise Investments

After making decent or good money in law smart lawyers do not waste money. We have seen lawyers investing in various investment vehicles. Many lawyers had IRA account and money in that account is invested in stocks, mutual, or index funds. This is the most basic way and passive way to invest money.

Other lawyers, we knew investing in real estate either solo or with partners. Some bought properties on foreclosures, some bought regular rental properties. Others invested in REITs. There are many ways to invest in real estate. We have heard of them also investing in precious metals such as gold. There are other ways to invest, but that is whole another topic.

8. 7 Figure Earn Investing in Yourself

Today, there are many resources on the internet geared towards helping lawyers improve their careers and, by extension, their incomes. Practical Law from Thomson Reuters, for instance, provides information that professionals can use to specialize in particular areas.

Does investing in your career make much of a difference? Well, it all depends on how much wealth you have right now. Why isn’t Elon Musk going back to university to finish his PhD? Because doing so probably wouldn’t make much of a difference in his wealth.

However, suppose our $120,000-a-year lawyer doesn’t have any investments and they are fresh out of law school. Now, the value of education goes up. With the right training, they could potentially double their pay to $240,000 after tax – and that would dramatically change their wealth trajectory. Earning more money can make a difference.

Overall, you will build wealth faster if you invest more than you spend, no matter your income.

The Two Truths You Need to Understand About Being a 7 Figure Earner and Millionaire Wealth Building Lawyer

FORMULA: 7 Figure Earnings vs. Unlimited Investments

7 Figures Earnings + Personal Financial Wealth Building = Wealth

- You can have an enormous income and still not be a millionaire or wealthy.

- Investments are a much more potent generator of money than work income.

The Power of Investments vs. Earnings

As a lawyer, you might be able to generate $300,000 per year. Some even earn more than $500,000. Again, these are exceptionally good incomes. However, they pale in comparison to what investments can achieve.

Let’s say, for instance, that you sell a business for $10,000,000 and have that money sitting in the bank. Then suppose that you use it to buy assets, such as stocks, private equity and property that returns 10 percent per year.

All of a sudden, you have an income of $1,000,000 per year, which is many times what you could earn working a regular professional job. What’s more, you didn’t even have to work for it. Instead, it came to you in the form of profits and rent from your investments.

Compare that to relying on your income alone. If you never invest, you will never generate more money than what you can earn. Instead, you will always have to sell your time for cash.

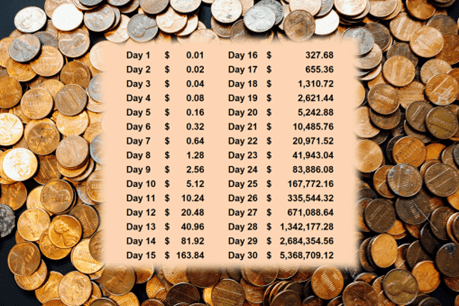

Become a 7 Figure Lawyer and Millionaire by Unerstanding and Applying the Power Of Compound Interest Through Investments

What’s interesting about this is how interest affects returns. Let’s say that you are regular lawyer earning $50,000 per year. You sets aside $30,000 per year — much less than the $100,000 per year frugal lawyer who puts it away.

That frugal regular worker winds up with $478,000 after ten years under the same arrangement, only slightly less than what the lawyer gets after five years. But why?

It has to do with the power of compounding. Even though the regular lawyer only invested 30% of the amount, interest payments added to their principle over time, helping them build their wealth faster.

Become a 7 Figure Lawyer and Millionaire by Understanding and Applying the Power of Personal Financie and Planning

Create a Budget –

When learning how to save money, the first order of business should be to create a budget – one that is realistic and manageable.

You wouldn’t manage a full course load in law school without some sort of calendar/schedule as a student. The same is true for a budget, which is simply a financial plan that is reduced to writing.

Adjust the Budget as Needed –

As a lawyer, you are likely to face many financial firsts. As such, it is critical to learn how to manage money, as this is an excellent habit that will benefit you for a lifetime.

After you have had a chance to work with your budget (give it six months, at least), take some time to determine if the first budget you have created is realistic and practical.

Be Mindful of Spending Habits –

One of the most straightforward financial tips for lawyers is simply to be aware of how you spend money by tracking it using a personal financial management application or Excel.

Search for Available Financial Help –

There are many scholarships (and other types of financial help for law students available) for which students only have to submit an online application if they qualify.

Begin to Establish a Credit History –

It is important to begin to establish a credit history, which can be done by applying for a credit card.

Boost Your Credit Score –

There are several ways to improve your credit score that requires little effort and expense. Maintaining a solid and robust credit score is some of the best financial help for lawyers as they move towards an independent financial future.

Start an IRA –

Yeah, retirement seems like it’s a long way off, but trust your elders – it’s not. If you have any earned income, even from a part-time job, you can open an IRA account and start putting money away. The benefit of an IRA is simple – since it’s taxed up-front, you can always remove money when you need it, or you can keep it in to grow with the stock market. Even an investment of a thousand dollars a year will grow enormously by the time you retire.

Open a Savings Account –

If a Roth seems like a big investment, please, seriously, at least open up a savings account or a Money Market at your bank. It will provide a marginal amount of interest, but it will also help keep you mindful of saving.

Avoid ATM Fees & Other Bank Junk Fees –

One of the easiest ways to learn how to save money is by avoiding bank junk fees – like ATM charges unnecessarily. Steering clear of avoidable ATM fees offers some of the simplest financial tips for lawyers.

If you must take out cash at an ATM that charges a fee, be sure to take out a large enough amount, so you do not have to use the ATM often. In the years ahead, you will come to see the value of this financial advice.

Get Paid for Giving Your Opinion by Taking Surveys Online –

If you are searching for how to make money without a job, you can get paid for giving your opinion in many places on the Internet.

It is easy to understand how to make money as a lawyer online by completing surveys, with many offering rewards in the form of cash, gift cards, or points from companies like Target, Walmart, and Office Depot, among others.

Financial Tips to Become a 7 Figure Lawyer and Millionaire

* Learn how to double your income.

* Learn the 50-30-20 Rule and the Concept of Compound Interest

* Invest in your skills that will double or triple your income

* Have a budget for expenses and investments or saving

* Try leasing the home instead of rent

* Don’t spend of liabilities like phones, clothes, phones, Footwear, TV etc..

- First save before you spend, at least save 10% of your income monthly read the book: The Richest Man in Babylon.

* Invest in passive income. Refer to Rich Dad Poor Dad Books.

* Build Passive income by blogging, YouTuber etc..

* Create a secondary active income. Start to build it with no capital or a minimal cap. Buy assets

* Buy a property to rent. You stay in lease.

* Triple your knowledge to double your income

* Take proven actions to succeed

* Always concentrate on dividends

* Become rich and marry middle class mate or partner. You can fulfill his or her rich dreams.

* Build multiple income sources

* Love yourself

* Bargain everything and get for cheap

* Love is expensive. Be rich before you fall for the liability

* Be healthy it’s saves lots money on healthcare

* Be busy

* Have a Mentor and MKS Master Key Self Made Millionaire Coach help you.

* Don’t showoff anyone

* Pretend poor until you have great Wealth

Business Tips to Achieve a 7-Figure Income and Millionaire Worth

1. Run Your Law Firm Like a Business.

You studied the law as a noble profession, but to break the seven-figure barrier, you must run your law firm like a business. As a solo practitioner or the owner of a small law firm, your primary focus – after gaining competency as an attorney – is to understand and apply the key principles of business development, operations, management and law firm marketing every single day. Watch These 100 Minutes If You Want To Get Rich:: https://www.youtube.com/watch?v=rI621b5QVdk

There are 10 major parts every successful law firm owner must focus on – in this order:

Marketing:

The purpose of marketing is to generate leads. There are a wide variety of ways to do this. Review: Jay Abraham Marketing Masterclasse Jay Abraham: 1 / 10

Review: Business Mastery | 2 Hour Marketing Masterclass with Jay Abraham: https://www.youtube.com/watch?v=zOMa_lNpWCYAll of them work, but they are not always suited for all situations, practice areas or attorneys. Review: Money Making Secrets of Marketing Genius Jay Abraham and Other Marketing Wizards by Mr X: https://www.youtube.com/watch?v=xBHLt5NNUWc

Find three-five different ways that work for you and use them frequently. Not every attorney will be a top Rainmaker, but everyone can do something to grow and market his or her practice. Review: Getting Everything You Can Out Of All You’ve Got by Jay Abraham: https://www.youtube.com/watch?v=qZLgf0JtEQs

Sales:

The purpose of sales is to close the deal or sign up the client. Review: Jay Abraham on Selling: Jay Abraham 1 / 24

Review: Jay Abraham and Consultative Selling: https://www.youtube.com/watch?v=nFCDLNEdpEg&list=PLMJVvqaVaDse2eIgGh34fd4G75H4fcjBQ

Once you start generating leads, you must become better at getting prospects to become paying clients. Review: The Only Sales Training You Need! [1 Hour Sales Masterclass] | Jay Abraham: https://www.youtube.com/watch?v=eY3ZgW0hvRw

Services:

Once you have become proficient at generating leads and closing the deal, you must perform the services for the client. When you fix your marketing, then you have a sales problem. When you fix your sales problem, then you have a services problem. See how this works? Review: The Strategy of Preeminence Understanding the Needs of Your Clients: https://www.youtube.com/watch?v=SI6Rm07Hfls

Staff:

When you become successful at marketing and sales, eventually you will also need more staff to do the work. You cannot hire just any staff; they must be the right staff for you. What kind of culture do you want your firm to have? Who will best fit that culture? Develop a list of qualities and characteristics you need your team members to have.

Systems:

Policies, procedures and systems allow you to scale to the next level. Without written systems you cannot scale your business. You will hit a breaking point. It may be at half a million or more, but eventually you will experience a lot of unnecessary pain and suffering because you didn’t invest in creating written policies, procedures and systems for your law firm. You need written systems for every major part of your business. From marketing and intake to money and metrics, it all must be logically written down so even a brand new team member who knows nothing about your business can follow it.

Space:

After you start hiring the right staff because you have more clients to serve, eventually you will need more office space to house them. Far too many attorneys get caught up in renting a much bigger or nicer space than they can afford in an attempt to “keep up with the Joneses” or give off the appearance of being more successful than they are. The pleasure you may gain from a fancy office is nothing compared with the worry of making those big payments every month. Don’t strap yourself with too many financial obligations and be careful about signing long term agreements, especially when you’re just starting off.

Money:

Very few attorneys went to school to become a bookkeeper or an accountant, but to manage a growing business you must know how to manage your money. You need to know the basics of finances for small business, from reading a profit and loss statement to analyzing your cash flow. Being an owner means other people are depending on you to manage the money wisely. Review: 7 Steps to Put Significant Money in your Business: https://www.youtube.com/watch?v=1uypYwj1ll4

Metrics:

To consistently break a million dollars per year in revenues, there are over a dozen numbers you must be monitoring and measuring consistently. Here are a few of them – unique website visitors each month, leads per month, average cost per lead by marketing channel (PPC, SEO, TV, radio, print, etc), appointments your team sets per month, show up rate to your appointments, conversion rate for initial consultation by attorney, average cost per client acquisition by marketing channel, cost of goods sold (COGS) per practice area and profit margin per practice area. This is not a comprehensive list, but if you know, measure and track each of those metrics every month, you’re on your way to comprehensively monitoring your business.

Strategy:

While having a great strategy is necessary, most attorneys spend too much time developing a strategy and too little time implementing the strategy! Get some leads in the door. Make the sale. Collect the money. Do great work. Obtain some referrals. Wash, rinse and repeat! Then work on your next level strategy. Review: You Will Get Rich When You Understand THIS! | Jay Abraham: https://www.youtube.com/watch?v=pPn-Q-QAfok

Self:

Upgrading yourself is the last, but most important step. You need to read business growth books or take classes or seminars if that fits your style of learning better. Hang around other successful business owners. Join a mastermind group of successful attorneys. Push yourself outside of your comfort zone. You will never build a multimillion-dollar law firm by staying inside your comfort zone.

2. Focus on a Niche.

When you’re in the startup phase (from $0 to about $250,000), you face a never ending challenge of taking whatever business comes in through the door in order to pay the bills or concentrating on one area to build a niche practice. It becomes a question of short-term focus versus long term survival – and we realize that most solos need to balance both in order to make it.

However, the faster you can start focusing on one to two practice area niches, the faster you will go from having a job ($0 to $500,000) to creating a practice ($500,000 to $1M). When people see you as a jack of all trades (the generalist approach), they also perceive you as the master of none. People will pay more for a specialist because they see you as an expert. People will refer more to a specialist because they aren’t afraid of you stealing their clients or competing with them. Contrary to popular belief, this approach does not limit you. It helps to focus your marketing and business development efforts.

There are many ways to select a niche, but it must be small enough to be realistic, yet big enough to have enough potential clients in it. For example, being No. 1 divorce attorney in all of the Phoenix metro area is not realistic. There are far too many entrenched and successful competitors to ever achieve this. However, you could be the No. 1 divorce attorney for entrepreneurs and small business owners in the East Valley. Here are a few other ways to select a niche:

- Service Niche: DUI attorney for licensed health care professionals; estate planning and asset protection for doctors and dentists; tax attorney for the self-employed; business transactional lawyer for real estate investors; business immigration law for the hi-tech industry; business law for health care providers; and IP and trademark lawyer for small business owners.

- Industry Niche: Technology, agriculture, doctors, transportation, restaurant owners, manufacturing, construction, energy, or real estate development.

- Geographic Niche: Phoenix, Gilbert, Tempe, Chandler, Scottsdale, or the East Valley.

- Specialty Market Niche: Privately held companies, Fortune 500, physicians, white collar executives, blue collar construction workers, franchise owners, bicycle accidents, fitness centers, Spanish-speaking clients, developers, or commercial lenders.

Review your top 10 client list (either by amount of revenue/fees generated or in terms of how much you enjoy working with them). Then, look for any similarities. It may not be apparent at first, but keep asking questions and you will find it. Building a niche around a solid client base is one of the fastest ways to differentiate yourself.

Another way to help determine your niche is to track the inquiries from prospective clients to determine what’s drawing them to you and your law firm. See if they don’t begin to naturally fall into one or more groups. Becoming aware of these commonalities is a way to let your niche find you, helping you develop your law firm marketing. Once you niche your practice, you will find that referrals come more readily to you, since it will become clear in referral source’s mind just exactly what it is you do.

3. Identify Your Ideal Target Market.

Your ideal target market (ITM) is the person or company who is most likely to retain you initially, repeatedly and at the highest profit margin. No matter what area of practice you are in, you can use these eight questions to help you determine your ideal client. We recommend you answer these questions with as much specificity as you can:

- What does your perfect client look like? (Think in terms of age, profession, gender, education, interests, work, marital status, family size, hobbies and lifestyle.)

- Who can afford your fees? How much can they afford? What’s your value to them?

- Who could be a good long-term, repeat client for your firm?

- What qualities, characteristics and values do they have?

- What are you helping them accomplish?

- What are their issues, challenges or pain?

- Who could be a good source of referrals for these ideal clients?

- Who is NOT your ideal client?

Identifying and targeting the right market is absolutely critical to the success of your law firm marketing plan. If you don’t target the right market, nothing else you do will matter. To be successful in your marketing, you must start with a clear picture of your perfect client.

4. Pay Attention to Your Firm’s Finances.

A LexisNexis survey of 309 U.S.- based law firms – 75 percent of which were firms with less than 10 attorneys – reports that 39 percent of a typical practice’s client accounts are past due. And of these past due accounts, only half are likely to be paid.

That’s a lot of cash flow down the toilet. Seventy-three percent of small firms in that survey said they have past due accounts and 53 percent of firms have client accounts that are past due. So why aren’t lawyers getting paid?

The number one reason cited by lawyers in the survey (82.5 percent) was “client financial hardship.” Here are the other reasons in order of prevalence:

- Client challenged value of charges.

- Miscommunication.

- Bill was for services performed too far in the past.

- Client disputed services.

- Bill format unclear to client.

In the “Other” category were these reasons for past due bills: invoices sent irregularly; poor tracking of fees and services; bills sent too infrequently and bill larger than client expected; inconsistent billing; corporate client with slow internal bureaucracy; and not a priority for client to pay.

It’s really hard to believe that four out of 10 clients are financial hardship cases. However, if these survey results are accurate, then law firms have a huge disconnect in one or more of these critical functions:

- Marketing: You are clearly marketing to and attracting the wrong type of client. Review: How to Get ANY Business to Grow FASTER! | Jay Abraham on Business Strategy: https://www.youtube.com/watch?v=Wc3t6Ki-Je8

- Sales: You are not managing client expectations or educating them on the value of your services or your retainer fee is not high enough to weed these types of clients out on the front end

- Business Processes: You have a broken billing model (i.e., hourly billing) or you do not have the proper systems in place to handle your billing and collections? How to STAND OUT and DOMINATE Your Market! | Jay Abraham on Preemptive Marketing: https://www.youtube.com/watch?v=kwnNSCkSz6E

- Review: Business Wealth Without Risk: https://www.youtube.com/watch?v=YMBYN5Qu8zI

In the survey, attorneys admitted to something we all know is true (and is a lot more believable than client financial hardship), lawyers hate asking clients for money. They find it embarrassing, distasteful, even greedy, but we don’t know any lawyers who finds money itself embarrassing, distasteful or greedy!

The problem is if you don’t expect to be paid; your receivables will probably reflect that. If you pursue your work on your client’s behalf with passion, you should pursue payment for that work with the same passion.

So you likely need to (1) change your attitude; (2) put better systems in place; and/or (3) task this out to someone who is not afraid to bulldog clients about their bills. Your survival depends on it!

So What Does All this Mean For Your 7 Figure Income and Millionaire Status?

Essentially, it means that as a lawyer you can become a 7 Figure Lawyer and join the ranks of the super-wealthy Millionaires (particularly if you keep saving and investing for decades). But you need to understand how savings and investments work — and many lawyers don’t.

When it comes to wealth, it’s not about how much money you make, it’s about how much you keep. If you have no wealth, earning a salary of $120,000 feels like a lot of money.

However, it ceases to matter as much when you earn the same amount or more in interest. In fact, if you knew you could reliably earn $120,000 per year from your investments, you might decide to retire.

Ready to Become a 7 Figure Lawyer and Millionaire Today?

Contact us for Business Without Risk. We’re offering you the chance to generate $1 MILLION for yourself and your family by joining us in MKS Master Key Self-Made Millionaire Coaching.

Live Long and Prosperously,

Reitenbach-Kissinger

The Self-Made Millionaire Factory

By: Michael Kissinger a Universal Law-Business Results Expert-Offering Proven Business Profit Optimization Results, Cash Flow Maximization, Funding, Marketing, Sales, Management, Leadership Coaching. Helped 10K+ Owners Earn/Save $1 Billion+

Text: 650-515-7545

Email: mjkkissinger@yahoo.com

PS. A million dollars is a lot of money, so you may be able to use it to tackle the above — get out of debt, set up an emergency fund, invest a lot of it for your future, and then… perhaps make a down payment on a new home, buy a new car, and take a big trip!

The Andrew Carnegie Financial Success Formula

by Napoleon Hill

The method by which DESIRE for riches can be transmuted into its financial equivalent, consists of six definite, practical steps, viz:

If you truly DESIRE money so keenly that your desire is an obsession, you will have no difficulty in convincing yourself that you will acquire it.

- First. Fix in your mind the exact amount of money you desire. It is not sufficient merely to say “I want plenty of money.”Be definite as to the amount. (There is a psychological reason for definiteness which will be described in a subsequent chapter).

- Second. Determine exactly what you intend to give in return for the money you desire. (There is no such reality as “something for nothing.)

- Third. Establish a definite date when you intend to possess the money you desire.

- Fourth. Create a definite plan for carrying out your desire, and begin at once, whether you are ready or not, to put this plan into action.

- Fifth. Write out a clear, concise statement of the amount of money you intend to acquire, name the time limit for its acquisition, state what you intend to give in return for the money, and describe clearly the plan through which you intend to accumulate it.

- Sixth. Read your written statement aloud, twice daily, once just before retiring at night, and once after arising in the morning.

AS YOU READ-SEE AND FEEL THE MONEY BELIEVE YOURSELF ALREADY IN POSSESSION OF THE MONEY.

It is important that you follow the instructions described in these six steps and the programs below.

It is especially important that you observe, and follow the instructions in the sixth paragraph. You may complain that it is impossible for you to “see yourself in possession of money” before you actually have it.

Here is where a BURNING DESIRE will come to your aid. If you truly DESIRE money so keenly that your desire is an obsession, you will have no difficulty in convincing yourself that you will acquire it.

The object is to want money, and to become so determined to have it that you CONVINCE yourself you will have it.

To the uninitiated, who has not been schooled in the working principles of the human mind, these instructions may appear impractical. It may be helpful, to all who fail to recognize the soundness of the six steps, to know that the information they convey, was received from Andrew Carnegie, who began as an ordinary laborer in the steel mills, but managed, despite his humble beginning, to make these principles yield him a fortune of considerably more than one hundred million dollars. Napoleon Hill

10 Rules Of Financial Success Andrew Carnegie Used To Become Incredibly Rich

Andrew Carnegie arrived in the U.S. in 1848 with barely a dollar to his name. By 1901, he was the richest man in the world. Carnegie gave him his “10 Rules of Success”.

1. Define your purpose.

Create a plan of action and start working toward it immediately.

2. Create a “master-mind alliance.”

Contact and work with people “who have what you haven’t.”

3. Go the extra mile.

“Doing more than you have to do is the only thing that justifies raises or promotions, and puts people under an obligation to you.”

4. Practice “applied faith.”

Believe in yourself and your purpose so fully that you act with complete confidence.

5. Have personal initiative.

Do what you have to without being told.

6. Indulge your imagination.

Dare to think beyond what’s already been done.

7. Exert enthusiasm.

A positive attitude sets you up for success and wins the respect of others.

8. Think accurately.

Accurate thinking is “the ability to separate facts from fiction and to use those pertinent to your own concerns or problems.”

9. Concentrate your effort.

Don’t become distracted from the most important task you are currently facing.

10. Profit from adversity.

Remember that “there is an equivalent benefit for every setback.”

Review for Money Success

- A Poor Person Who Does This Gets Rich Quick – Secret Revealed: https://www.youtube.com/watch?v=Cuvz9yJbGHk&t=24s

- Any Poor Person Who Does This Will Become RICH Almost Immediately: https://www.youtube.com/watch?v=z3RKnFACprE

- Any POOR person who does this becomes RICH in 6 Months | Warren Buffett

- Any POOR person who does this becomes RICH in 6 Months

- Any POOR Young Adult Who Does this Becomes RICH Regardless Of Your Current Situation: https://www.youtube.com/watch?v=nex1wDycjj8&t=68s

Review for Understanding Your Personal Finance

Are You Enjoying the Financial Life You Were Meant to Live? Ready to Discover How to Access Your Hidden Financial Power Within to Transform Your Wealth and Net Worth Results? Listen to This.

Personal Finance for Beginners (Literacy & Education) Managing Your Money Audiobook – Full Length

Money Management for Beginners Education (Manage Your Finance and Wealth) Audiobook – Full Length

Passive Income Ideas for Beginners & Dummies (Business & Entrepreneurs) Audiobook – Full Length

Financial Literacy for Beginners & Dummies – Personal Finance Education Money Audiobook Full Length

Financial Literacy 101 | Life Changing Financial Education Revealed – Audiobook

Achieve Personal Finance Success (Investing & Passive Income) | Audiobook

How to Invest Your First $1000 | Stock Market Trading | Audiobook for Beginners

Money Affirmations – Attract Wealth and Riches (Everyday Motivation!) |

Starting a Business for Beginners & Dummies (Entrepreneur & Wealth Motivation) Audiobook Full Length

How to Succeed | Motivation & Self Improvement | Full Length Inspirational Audiobook English

Stock Market Investing (with subtitles) | Beginners & Dummies Full Audiobook Relaunch

Secrets of Self Improvement Revealed – Self help 101

How to Focus on Self Development and Accomplish Growth | Audiobook

Review the 11 Common Types of Investments

Investing can intimidate a lot of people because there are many options and it can be hard to figure out which investments are right for your portfolio. This walks you through ten of the most common types of investments, from stocks to commodities and explains why you may want to consider including each in your portfolio.

The 3 Main Investment Categories

While the types of investments are numerous, it is possible to group them into one of three categories, equity, fixed-income and cash or cash equivalents.

The term “equity” covers any kind of investment that gives the investor an ownership stake in an enterprise. The most common example is common stocks. Other examples are preferred shares, funds that hold stocks, such as exchange-traded funds and mutual funds, private equity and American depositary receipts.

The term fixed-income covers any kind of investment that entails the investors essentially loaning money to an enterprise. The most common example is bonds, which come in various forms, including corporate and government, whether local, state or federal. Some fixed-income securities have equity-like characteristics, such as convertible bonds.

Cash and cash equivalents comprise a third type of investments. Besides bills such as you might keep in a wallet, this type includes checking accounts, savings accounts, certificates of deposit and money market accounts. Money market funds are sometimes considered cash equivalents because it’s easy to withdraw from such accounts, but they are technically fixed-income securities – albeit extremely secure securities.

11 Types of Securities

While it is possible to put investments into one of three categories, as described above, there are many types within these categories. Here are 11 key examples.

1. Stocks

2. Bonds

3. Mutual Funds

4. Exchange-Traded Funds (ETFs)

5. Certificates of Deposit (CDs)

6. Retirement Plans

7. Options

8. Annuities

9. Derivatives: The three most common types of derivatives are:

Options Contracts: – Futures Contracts: — Swaps:

10. Commodities Here’s a breakdown of the four main types of commodities:

- Metals: precious metals (gold and silver) and industrial metals (copper)

- Agricultural: Wheat, corn and soybeans

- Livestock: Pork bellies and feeder cattle

- Energy: Crude oil, petroleum products and natural gas

11. Hybrid Investments

Hybrid investments incorporate elements of equities and fixed-income securities. One such example is preferred shares, which is an equity security with a bond-like feature.

Another type of hybrid is a convertible bond. It is a corporate bond that can be “converted” into shares of the company.

Stock Market Investing (with subtitles) | Beginners & Dummies Full Audiobook Relaunch

Starting a Business for Beginners & Dummies (Entrepreneur & Wealth Motivation) Audiobook Full Length

Review for Gaining BIBLICAL PROSPERITY

How to Thrive and Attract Abundance According to the Bible: https://www.youtube.com/watch?v=5qMEXow52U0&list=PLYyn-UVutcNAWathZ88vebl6ndhG9EHev&index=1

Review to Discover How to Get Rich

A Poor College Person Who Do This Gets Rich Quick – Secrets Revealed: https://www.youtube.com/watch?v=Cuvz9yJbGHk&list=PLYyn-UVutcNCHfd8sSv0lmCax3sNdka2c&index=1

Secrets of 7 Figure Rain Makers

Recommended Secrets of 7 Figure Rain Makers: https://my.lawyerbookbuilder.com/lbb-secret-techniques-of-7-figure-rainmakers

Recommended Law Firm Marketing Tips: https://davidfreemanconsulting.com/videos/

Recommended Law Firm Leadership Tips: https://davidfreemanconsulting.com/videos/

Review to Know The Self-Made Millionaire Coaches and Team

- MKSmasterkeycoaching.com

- MKS Master Key Self-Made Millionaire Coaching will Teach You How to be a Self-Made MILLIONAIRE: https://lnkd.in/gnKkxZqG

- MKS Master Key Self Made Millionaire Challenge mksmasterkeycoaching.com

- MKS Master Key Testimonials https://lnkd.in/gMS7XUg8

- The MKS Master Key Four Year Career Plan: https://www.youtube.com/watch?v=Cm0e4uaBezg&list=PLoGByZSY8c87Jg01rwf2MYjCnQlm9XF3a