Turn Your Annual Income Into 7 Figures and Retire from Your Small Business, Profession or Career Financially Free

Enjoy the Freedoms You and Your Family Work For Every Day!

Follow These Easy and Simple Steps and You’ll Be on the Road to Becoming a Millionaire!

The Median Income of all Middle-Class Households

The median income of all middle-class households, regardless of household size, was $90,131 in 2020, according to the latest available data from Pew Research Center.

- Hawaii. $122,695. $83,102.

- California. $111,206. $80,440.

- Massachusetts. $85,567. $85,843.

- Colorado. $81,602. $77,127.

The Average Small Business Owner’s Salary in the U.S.

The average small business owner’s salary in the U.S. is just above $62,000 annually, or roughly $30 an hour, according to Dec. 2021 data from ZipRecruiter.

Business owners are in a unique position to build their wealth. As a business owner, you can build your wealth through your business. You have more control over the money you bring in, the profit you create in your business, and what to do with that profit. Knowing how to become rich as a business owner is a critical knowledge.

The Average Income of All Low Income Households

A widely used federal guideline defines low income as $14,580 annually for one person and $30,000 for a family of four. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

The Most Common Way These People Become Rich? As in Millionaire or even Multimillionaire Rich?

You may think this sounds cheesy but it’s literally the foundation to the mind of the rich. To become rich, you have to change your mentality first before anything else.

Becoming wealthy is a mindset that should last forever. The rich have mindsets that are unique and like no other. Many people don’t or should not be able to understand the reasons why the rich are the way they are.

We would go as far as to say that people should indeed think that the rich are weird people to an extent. Why do we say this? Because the majority of the population anywhere are working class citizens and all working class citizens have like minded mindsets, which explains why they all are where they are financially and economically. Probably where they all don’t want to be.

The most common successful ways these people can get rich from what we have either witnessed or experienced from own own personal experiences is;

1) Invest (this includes buying assets that provide passive income for them).

The rich do not work for other people. They hate 9–5 jobs that provide “earned income”. Earned income is almost never emphasized anywhere near as much as passive income in rich households. Doesn’t hurt but it’s definitely not the #1 financial priority.

2) Become innovative and get wealthy off the innovations.

If those innovations are successful. (Innovating something is very common amongst a lot of people and it wouldnt surprise us if this method is actually the most common approach to getting rich). This can include owning a business or operating/leading a successful business (these are entrepreneurs).

3) Live a healthy lifestyle forever.

You’d be surprised of the correlation of being healthy has to your financial future. The mind, body, and soul is real and a huge part of the way people live their lives.

A mind in a healthy body is literally like a weapon for mass success. A person that is sluggish and unhealthy will typically not have the motivation nor the physical drive to do the things necessary that requires hard work to become rich. We have personally seen this so many times. Many unhealthy people are indeed lazy.

4) Always hang around or affiliate with wealthy or rich people.

If you are a person trying to become rich, it may be unhealthy to be around negative broke people. This can include family members also. Stay away from these types of people. Words are a powerful thing. If you are around people that are constantly negative and discouraging, it can definitely have a negative effect on you. This should be a no brainer.

5) Most Rich Are Loners.

Rich folk are extremely independent. They rely and depend on nobody but themselves and only themselves. Most of the time we’ve seen that they either live single alone by themselves or they have a very small family with maybe a wife and kid or 2.

6) Get a Financial Education. Educate yourself about finance and wealth building.

Many rich folk or people trying to get rich are constantly looking for new ways to build wealth or sustain the wealth that they already have.

They are constantly investing, buying more and more assets, going to conferences and webinars, taking up continuing education on investing opportunities or business ventures. The list goes on with this.

Although we’re already rich, we still watch investing YouTube videos for learning, reading books, or just somehow constantly finding a new way to build on our current position. Many of these things that we do is the reason why we have been able to find good financial institutions to park our money that pays us in a significant amount passive income through high yield returns (High Yield Savings Accounts specifically). Remember, it’s all about that passive income!! Take care.

What Every Person Should Do to Become Rich!

There are many legal ways to become a millionaire while living in these three income levels. Through careful financial planning, taking advantage of benefits for education, and potentially obtaining high-ranking positions, it is possible to become a millionaire in 6-12 Months.

1. Avoid expense creep

2. Pay yourself first

3. Increase your income

4. Invest in yourself

5. Make Taxes through Deductions: (40% of your income is taxed in the military)

6. Make your money work for you

a. Thrift Savings Plan

b. Index Funds

c. Rental Properties

7. Marry Intelligently

8. Network with another millionaires

9. Avoid these Pitfalls on the Road to Becoming a Millionaire!

1. New Cars

2. New Homes

3. Drugs

4. Tattoos/Alcohol

5. Wasting time

Remember, there is no guaranteed formula for becoming rich. Building wealth and achieving financial success takes hard work , dedication , and a bit of luck . That being said , there are certain industries, businesses, careers, plans, strategies, etc. that have a higher potential for generating significant profits or income in a shorter amount of time

One potential business that could potentially make you a millionaire in two years is the technology industry . With the rapid advancements and constant demand for new and innovative technology , there is a lot of potential for growth and success . This could include starting your own tech company , investing in promising startups , or even creating and selling your own tech products .

Another potential avenue for becoming a millionaire in a few years is through real estate investing . While it may take some time to build up a portfolio and see significant returns , real estate has the potential for generating a high income in a relatively short amount of time . This could include flipping houses , investing in rental properties , or even developing and selling properties .

Ultimately , the key to becoming a millionaire is to find a business or industry or profession or career that aligns with your skills , passions , and goals . It ‘s important to do thorough research, create a solid business plan, and be prepared to work hard and take risks . With determination and the right opportunities, it is possible to achieve financial success in a short amount of time .

30 Simple and Easy Tips to Apply While Becoming a Millionaire

- One child is gold, further you are adding loans.

- Look for a working life partner to have a much better quality of life.

- Start saving and investing since the first day of job, so that you can cope up when responsibilities hit you hard.

- “Assets are those products whose value increases with time and are re-sellable, rest everything is a liability”, never forget this.

- Exercise and walk in public parks, don’t spend in gyms, unless you are too passionate.

- Make a diary of fixed monthly expenditures and allocate money to each class, to have a planned spending every month.

- Invest something out of the minimum salary you get in a pension plan. Old age can be quite harsh.

- Go to public gardens, temples on picnics, go often and take home cooked tiffin, make life interesting without spending much.

- Have a limited closely bound social circle to reduce expenditure and to avoid the tendency of showing off.

- Don’t keep a credit card, it’s too lucrative, specially when you are a little deprived in life.

- Prioritize expenditures, first is groceries, then child education, then bills, then leisure.

- You desperately need growth, keep acquiring new skills without fail, work part time also if possible.

- Delay your purchases but get products of decent quality to avoid high wear and tear and replacement costs.

- Take good care of household utensils and gadgets to prolong their life.

- Try and do maximum grocery shopping on one particular day every month to have economies and avoid travelling cost later on.

- Create an emergency fund out of any bonus money you get.

- Prefer wholesale markets over malls, you will find many products of fine quality (specially clothes, shoes, bags, plastic products) available at half the prices.

- Try and do shopping on weekdays at morning to have maximum bargaining power.

- Visit mall once in a while with child and spouse, let them enjoy a softy or a burger, it won’t cost much, and their cravings would be reduced. (But don’t step in a resto bar by mistake)

- Use apps like YouTube for entertainment, avoid boasting on apps like Facebook.

- Avoid wastage like cinema hall food, maintaining a car, alcohol, smoking etc.

- If you live life in a systematic and planned manner, life with low funds can also be happy and content.

- Try and use permanent birth control measures once you complete your family.

- Protect yourself as much as possible, you can’t afford to be casual, so use a helmet while travelling and wear clothes as per season.

- Have friendship with neighbours, you won’t need to travel to meet and chat with them, also you can pool certain resources and save some money.

- Eat seasonal fruits and experiment new recipes of cooking inexpensive vegetables like potato.

- On outdoor visits once in a while, carry as much water and food as you can, plan in advance and save money on tickets and stays, shopping while holidaying is overrated, avoid it.

- Use low potency, light AC’s in a combination with a fan to save electricity, similarly use LED technology for lighting.

- Live your family life with love and care so that money loses a little value.

- Most important, have peace of mind, stay away from stress and negative people, focus on happiness and togetherness, a lot of money would be saved automatically.

Ready to Make the Jump? 17 Side Hustles to Make Extra Income

1. Write an “app” that takes off.

2. Write a best seller in your spare time

3. Start a Military Blog

4. Start a YouTube Channel

5. Become an Online Fitness Instructor

6. Open an Online Store

7. Sell Digital Products Online

8. Create and Sell An Online Course

9. Write an Ebook

10. Start a Retail Arbitrage Business

11. Become a Writer/Editor

12. Become a Video/Podcast Editor

13. Offer Pet Sitting Services

14. Offer Graphic Design Services

15. Become a Remote Travel Agent

16. Join Survey Sites

17. Join MKS Master Key Financial Freedom Coaching Team.

Of course it’s important for you to consider the effect your side hustle may have on your income. You need to avoid side hustles that may conflict with your obligations to yourself or family, or violate any laws or regulations.

Read the rest of this information to learn how you can go from average income earner to entrepreneurship to millionaire so you can start supplementing your income right now and build wealth in the future.

The MKS Master Key Self-Made Millionaire Financial Freedom Project Helps You Become Wealthy

This is intended for people looking to take control of their finances and get on the road to becoming a millionaire

The Financial Freedom Project is a super-exclusive program that will help you take your profession, business or career to the first million in revenue. In this program, we will share for the first time ever, everything we did to hit that milestone in such a short time.

Most people don’t become financially independent because they never get to learn the inner game of money. The school system across the world never included the financial education in their curriculum. The millionaire project is a humble attempt to spread the knowledge on money and achieving financial freedom.

Through these courses and programs, you will cover a variety of personal finance topics, including budgets, investing, and managing risk. The readings, videos, and activities will prepare you to understand the current state of your money, as well as take actions to work toward your financial goals. This specialization is geared towards learners in the United States of America.

In each course and program, you will get to apply the skills they are reading and hearing about through activity coaching and worksheets that allow you to apply the personal finance concepts towards their own money situation – including a budget, financial goals, and strategy. Read more

1. Introduction to Personal Finance

There are 4 modules in this course

This course is a general overview of a variety of personal finance topics – including budgeting, the importance of your credit score, cash flow, setting financial goals, and taxes. Taught by two CERTIFIED FINANCIAL PLANNER™ Professionals, the concepts are broken down through videos, readings, and activities so you can apply what you are learning in real time.

The course provides the foundation to build on for the rest of The Fundamentals of Personal Finance Specialization or as a standalone survey course to improve your understanding of basic personal finance terminology, as well as how they apply to your own financial situation.

Whether you are just starting college, nearing retirement, or somewhere in between, this course will provide you with the knowledge to understand your money and actionable steps to manage your finances in the future. This course is geared towards learners in the United States of America.

- Introduction to Personal Finance

- Saving Money for the Future

- Managing Debt

- Fundamentals of Investing

2. Saving Money for the Future

There are 4 modules in this course

This course is designed for anyone who currently has, or will have in the future have, savings goals. Learners will come to understand the importance of compounding growth, the variables that impact setting goals like retirement savings, and how much money you need to save now to reach future goals.

The course will help learners think through individual goals, like retirement, but also how those goals fit into your bigger financial picture. For example, saving for retirement, buying a home, and funding college for your kids all at the same time. The instructors will also cover how preparing for emergencies can prevent the derailment of those financial goals.

The concepts covered in this course are broad but through the activities offered, learners will see how to apply what they are learning about saving money for the future to their lives now. This course is geared towards learners in the United States of America.

- Introduction to Personal Finance

- Saving Money for the Future

- Managing Debt

- Fundamentals of Investing

3. Managing Debt

There are 4 modules in this course

This course is aimed at anyone who has debt, is thinking of taking on debt, or wants to better understand debt as part of your overall financial picture. It covers a variety of debt types, as well as debt payment options.

The course will help you assess your current debt situation and understand the paths to paying off your debt. This includes categories such as mortgages, credit card debt, and student loans. Learn how to differentiate between good and bad debt, as well as how to think about debt as you work towards your financial goals. This course is geared towards learners in the United States of America.

- Understanding the Basics of Debt and Home Loans

- Addressing Student Loan Debt

- Managing Credit Cards and other Debt

- Paying Down Debt Strategically

4. Fundamentals of Investing

There are 4 modules in this course

This is primarily aimed at novice investors who want to better understand the concept of investing and how it can fit into their overall financial plan. This course will cover different investment vehicles, risk tolerance, diversification, and the difference between active and passive investing, as well as investment fees and taxes.

Whether you are just getting started investing or want to play a more active role in your investment decisions, this course can provide you the knowledge to feel comfortable in the investing decisions you make for yourself and your family. This course is geared towards learners in the United States of America.

- Understanding the Different Types of Investment

- Balancing Risk and Return

- Developing an Investment Strategy

- Understanding Taxes and Fees

5. Risk Management in Personal Finance

There are 4 modules in this course

This course is primarily aimed at those who want to understand more about how they can protect their finances from unexpected events. This course covers the role insurance plays into your financial plan, including what kinds of insurance to explore, how to determine how much insurance you need, and how different kinds of insurance works.

The course includes life insurance, health insurance, disability insurance, homeowners insurance, renters insurance, auto insurance, and umbrella insurance. You will also learn about estate planning, including the documents involved and special considerations for new parents.

This course helps you understand how protecting your money is an important part of financial planning. It is geared towards learners in the United States of America.

- Understanding Basic Insurance Concepts

- Protecting Against Death and Disability

- Insuring Your Home Apartment or Car

- Implementing Estate Documentation

These are Some of the Most Important Money Lessons that School Failed to Teach Us to Become Wealthy

By understanding the true nature of money, investing wisely, leveraging debt, avoiding social pressure, optimizing tax strategies, and focusing on production, we can break out of the conventional system and achieve financial security. It’s crucial to educate ourselves and take control of our financial future.

If you want to learn how to make smart financial decisions, save more and eliminate debt, you’re in luck. Today there are plenty of free online personal finance classes to sharpen your money-management skills.

Keep in mind that online personal finance courses should be seen as an education resource and not specific personal financial advice “The information learned from taking a MKS Master Key Self-Made Millionaire Personal Finance Courses should be applied within the context of your own financial situation, rather than following everything that is taught 100% to a T.

Too often, people read or hear something from a personal finance expert or a course that they are compelled to act on. Some things that you learn about in a personal finance course may not be applicable to you or may not be appropriate to implement in your own life.

MKS Master Key Self-Made Millionaire Personal Finance Course lessons can not only help you boost your money-management skills but may also inspire you to reflect on saving and spending patterns and help you build a strong foundation for success.

MKS Master Key Self-Made Millionaire Personal Finance Course lessons also drill down into topics including Roth IRAs, 401(k)s, stocks, bonds, certificates of deposit and strategies for eliminating credit card debt. In a nutshell, it can never hurt to try and be better informed about how you spend money.

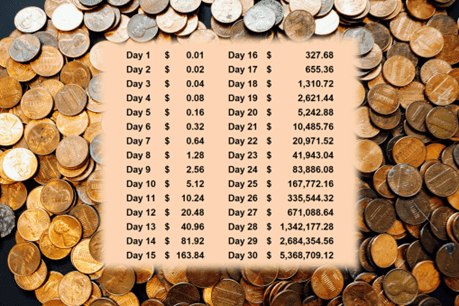

What Happens if You Double a Penny a Day for 30 Days?

Got $400 a Month? Here’s How to Turn It Into a $3 Million Nest Egg Under the Law of Compouning

if you sock away $400 a month over a 43-year period, and your invested savings generate an average annual 10.5% return, then you’ll end up with $3.3 million. And that should be enough money to enjoy your military retirement to the fullest.

From 1957 through 2021, the S&P 500 index graced investors with an average annual return of 10.5%.

If you don’t manage to start saving for retirement until age 30, and you can’t swing more than $400 a month in your IRA or 401(k), then you may need to work until your early 70s to hit that $3 million target.

How can an 18 year old, brand new in the work force and on a low income ever hope to become a millionaire?

IT IS EASY! Put $400.00 per month into the ROTH TSP and Become a Millionaire under the Law of Compound Interest.

Get together with someone who is TSP savvy and ask them where you should put your money and then leave it. Put the money in and forget about it until you get out of the military.

If you (at age 18) do this for 4 years, then you will be a millionaire by the time you retire at 65. You may have many millions of dollars depending on what mutual funds you choose.

How does this work? How does $400.00 per month make me a millionaire: The math is simple:

Year 1: You put in $4,800. You have 47 years until retirement. If you invest your money and receive a 10% annual rate of return, your $4,800 will turn into $423,000 at age 65.

Year 2: You put in an additional $4,800. You have 46 years until retirement. If you invest your money and receive a 10% annual rate of return, your $4,800 will turn into $384,000 at age 65.

Year 3: You put in an additional $4,800. You have 45 years until retirement. If you invest your money and receive a 10% annual rate of return, your $4,800 will turn into $350,000 at age 65.

Year 4: You put in a final $4,800. You have 44 years until retirement. If you invest your money and receive a 10% annual rate of return, your $4,800 will turn into $318,000 at age 65.

If you add up the retirement values of your investments, you come up with $1,475,000.

The most significant factors working against your millionaire status are debt and time. Becoming a millionaire is possible, no matter your situation, so long as you can keep these two factors on your side. If you can avoid consumer debt and start investing every month when you’re in your 20s or 30s, you can be a millionaire by the time you retire. …

Ready to Retire from Your Present Small Business, Profession or Career Financially Free

Contact and Join Us in MKS Master Key Self-Made Millionaire Personal Finance Coaching and Mentoring to Become Wealthy.

Sometimes you just need someone to break it down and show you step-by-step how to do it. We offer programs at various levels ranging from free / get started bootcamps to hands-on / step-by-step programs that have changes lives.

You’ll learn how you use your skills to build wealth through real estate investing, entrepreneurship, and personal finance…so you never have to work a day in your life.

We’ll help you eliminate some of the Biggest Financial Mistakes People Make and how to manage your money better while utilizing and practicing your other skills so You Achieve Financial Freedom and Success.

Our Mission to Help People and their Families Get Rich!

Our Mission is to help all people and their families learn how to build wealth through entrepreneurship, small business, real estate investing, entrepreneurship, and personal finance!

We’ll help you FREE eliminate some of the Biggest Financial Mistakes Military Members Make and help you to manage your money better while utilizing and practicing your other skills so You Achieve Financial Freedom and Success.

Live Long and Prosperously,

Reitenbach-Kissinger Institute

The Self-Made Millionaire Factory

Michael Kissinger is Universal Law-Business Results Expert-Offering Proven Business Profit Optimization Results, Cash Flow Maximization, Funding, Marketing, Sales, Management, Leadership Coaching. Helped 10K+ Owners Earn/Save $1 Billion+ and an Honorably Discharged US Army Special Forces Member

Text: 650-515-7545

Email: mjkkissinger@yahoo.com

PS. If you ‘re interested in learning more about potential businesses or industries or professions, or careers that could make you a millionaire, be sure to check out this entire page for more tips and insights . Remember, success takes time and effort , but with the right mindset and strategies, anything is possible .

PPS. A million dollars is a lot of money, so you may be able to use it to tackle the above — get out of college debt, set up an emergency fund, invest a lot of it for your future, and then… perhaps make a down payment on a new home, buy a new car, and take a big trip! We do not guarantee your results because each person and their work efforts are different.

The Andrew Carnegie Financial Success Formula

The method by which DESIRE for riches can be transmuted into its financial equivalent, consists of six definite, practical steps, viz:

If you truly DESIRE money so keenly that your desire is an obsession, you will have no difficulty in convincing yourself that you will acquire it.

- First. Fix in your mind the exact amount of money you desire. It is not sufficient merely to say “I want plenty of money.”Be definite as to the amount. (There is a psychological reason for definiteness which will be described in a subsequent chapter).

- Second. Determine exactly what you intend to give in return for the money you desire. (There is no such reality as “something for nothing.)

- Third. Establish a definite date when you intend to possess the money you desire.

- Fourth. Create a definite plan for carrying out your desire, and begin at once, whether you are ready or not, to put this plan into action.

- Fifth. Write out a clear, concise statement of the amount of money you intend to acquire, name the time limit for its acquisition, state what you intend to give in return for the money, and describe clearly the plan through which you intend to accumulate it.

- Sixth. Read your written statement aloud, twice daily, once just before retiring at night, and once after arising in the morning.

AS YOU READ-SEE AND FEEL THE MONEY BELIEVE YOURSELF ALREADY IN POSSESSION OF THE MONEY.

It is important that you follow the instructions described in these six steps and the programs below.

It is especially important that you observe, and follow the instructions in the sixth paragraph. You may complain that it is impossible for you to “see yourself in possession of money” before you actually have it.

Here is where a BURNING DESIRE will come to your aid. If you truly DESIRE money so keenly that your desire is an obsession, you will have no difficulty in convincing yourself that you will acquire it.

The object is to want money, and to become so determined to have it that you CONVINCE yourself you will have it.

To the uninitiated, who has not been schooled in the working principles of the human mind, these instructions may appear impractical. It may be helpful, to all who fail to recognize the soundness of the six steps, to know that the information they convey, was received from Andrew Carnegie, who began as an ordinary laborer in the steel mills, but managed, despite his humble beginning, to make these principles yield him a fortune of considerably more than one hundred million dollars. Napoleon Hill

10 Rules Of Financial Success Andrew Carnegie Used To Become Incredibly Rich

Andrew Carnegie arrived in the U.S. in 1848 with barely a dollar to his name. By 1901, he was the richest man in the world. Carnegie gave him his “10 Rules of Success”.

1. Define your purpose.

Create a plan of action and start working toward it immediately.

2. Create a “master-mind alliance.”

Contact and work with people “who have what you haven’t.”

3. Go the extra mile.

“Doing more than you have to do is the only thing that justifies raises or promotions, and puts people under an obligation to you.”

4. Practice “applied faith.”

Believe in yourself and your purpose so fully that you act with complete confidence.

5. Have personal initiative.

Do what you have to without being told.

6. Indulge your imagination.

Dare to think beyond what’s already been done.

7. Exert enthusiasm.

A positive attitude sets you up for success and wins the respect of others.

8. Think accurately.

Accurate thinking is “the ability to separate facts from fiction and to use those pertinent to your own concerns or problems.”

9. Concentrate your effort.

Don’t become distracted from the most important task you are currently facing.

10. Profit from adversity.

Remember that “there is an equivalent benefit for every setback.”

Review for Transitioning into College for Success

- 10 Degrees You Should Study If You Want To Be Rich: https://www.youtube.com/watch?v=RL3Nfu8Qpj0

- 7 things to do before you graduate college: https://www.youtube.com/watch?v=aNTA9FlJVco

- The Most Successful People Explain Why a College Degree is USELESS

- Unemployed After College? My Experience & Advice No One Wants to Tell You: https://www.youtube.com/watch?v=WMdznNQ8bQk

- Former College President Explains the Funding Strategies Behind Universities: https://www.youtube.com/watch?v=SRAfRu4ez_s

Review for Money Success

- A Poor Person Who Does This Gets Rich Quick – Secret Revealed: https://www.youtube.com/watch?v=Cuvz9yJbGHk&t=24s

- Any Poor Person Who Does This Will Become RICH Almost Immediately: https://www.youtube.com/watch?v=z3RKnFACprE

- Any POOR person who does this becomes RICH in 6 Months | Warren Buffett

- Any POOR person who does this becomes RICH in 6 Months

- Any POOR Young Adult Who Does this Becomes RICH Regardless Of Your Current Situation: https://www.youtube.com/watch?v=nex1wDycjj8&t=68s

Review for Understanding Your Personal Finance

Are You Enjoying the Financial Life You Were Meant to Live? Ready to Discover How to Access Your Hidden Financial Power Within to Transform Your Wealth and Net Worth Results? Listen to This.

Personal Finance for Beginners (Literacy & Education) Managing Your Money Audiobook – Full Length

Money Management for Beginners Education (Manage Your Finance and Wealth) Audiobook – Full Length

Passive Income Ideas for Beginners & Dummies (Business & Entrepreneurs) Audiobook – Full Length

Financial Literacy for Beginners & Dummies – Personal Finance Education Money Audiobook Full Length

Financial Literacy 101 | Life Changing Financial Education Revealed – Audiobook

Achieve Personal Finance Success (Investing & Passive Income) | Audiobook

How to Invest Your First $1000 | Stock Market Trading | Audiobook for Beginners

Money Affirmations – Attract Wealth and Riches (Everyday Motivation!) |

Starting a Business for Beginners & Dummies (Entrepreneur & Wealth Motivation) Audiobook Full Length

How to Succeed | Motivation & Self Improvement | Full Length Inspirational Audiobook English

Stock Market Investing (with subtitles) | Beginners & Dummies Full Audiobook Relaunch

Secrets of Self Improvement Revealed – Self help 101

How to Focus on Self Development and Accomplish Growth | Audiobook

Review the 11 Common Types of Investments

Investing can intimidate a lot of people because there are many options and it can be hard to figure out which investments are right for your portfolio. This walks you through ten of the most common types of investments, from stocks to commodities and explains why you may want to consider including each in your portfolio.

The 3 Main Investment Categories

While the types of investments are numerous, it is possible to group them into one of three categories, equity, fixed-income and cash or cash equivalents.

The term “equity” covers any kind of investment that gives the investor an ownership stake in an enterprise. The most common example is common stocks. Other examples are preferred shares, funds that hold stocks, such as exchange-traded funds and mutual funds, private equity and American depositary receipts.

The term fixed-income covers any kind of investment that entails the investors essentially loaning money to an enterprise. The most common example is bonds, which come in various forms, including corporate and government, whether local, state or federal. Some fixed-income securities have equity-like characteristics, such as convertible bonds.

Cash and cash equivalents comprise a third type of investments. Besides bills such as you might keep in a wallet, this type includes checking accounts, savings accounts, certificates of deposit and money market accounts. Money market funds are sometimes considered cash equivalents because it’s easy to withdraw from such accounts, but they are technically fixed-income securities – albeit extremely secure securities.

11 Types of Securities

While it is possible to put investments into one of three categories, as described above, there are many types within these categories. Here are 11 key examples.

1. Stocks

2. Bonds

3. Mutual Funds

4. Exchange-Traded Funds (ETFs)

5. Certificates of Deposit (CDs)

6. Retirement Plans

7. Options

8. Annuities

9. Derivatives: The three most common types of derivatives are:

Options Contracts: – Futures Contracts: — Swaps:

10. Commodities Here’s a breakdown of the four main types of commodities:

- Metals: precious metals (gold and silver) and industrial metals (copper)

- Agricultural: Wheat, corn and soybeans

- Livestock: Pork bellies and feeder cattle

- Energy: Crude oil, petroleum products and natural gas

11. Hybrid Investments

Hybrid investments incorporate elements of equities and fixed-income securities. One such example is preferred shares, which is an equity security with a bond-like feature.

Another type of hybrid is a convertible bond. It is a corporate bond that can be “converted” into shares of the company.

Stock Market Investing (with subtitles) | Beginners & Dummies Full Audiobook Relaunch

Starting a Business for Beginners & Dummies (Entrepreneur & Wealth Motivation) Audiobook Full Length

Review for Gaining BIBLICAL PROSPERITY

How to Thrive and Attract Abundance According to the Bible: https://www.youtube.com/watch?v=5qMEXow52U0&list=PLYyn-UVutcNAWathZ88vebl6ndhG9EHev&index=1

Skill Invest1 / 9

Review to Discover How to Get Rich

A Poor College Person Who Do This Gets Rich Quick – Secrets Revealed: https://www.youtube.com/watch?v=Cuvz9yJbGHk&list=PLYyn-UVutcNCHfd8sSv0lmCax3sNdka2c&index=1

Skill Invest1 / 79

Review to Know The Self-Made Millionaire Coaches and Team

- MKSmasterkeycoaching.com

- MKS Master Key Self-Made Millionaire Coaching will Teach You How to be a Self-Made MILLIONAIRE: https://lnkd.in/gnKkxZqG

- MKS Master Key Self Made Millionaire Challenge mksmasterkeycoaching.com

- MKS Master Key Testimonials https://lnkd.in/gMS7XUg8

- The MKS Master Key Four Year Career Plan: https://www.youtube.com/watch?v=Cm0e4uaBezg&list=PLoGByZSY8c87Jg01rwf2MYjCnQlm9XF3a