Or Do You Want Strength, Empowerment, Focus, Fun, Money, to Play, to Earn a Fortune, Work You Love, Have a Successful Life, Career, Business, or Family Relationship? Or ALL of It!

Feeling powerless & helpless can be challenging to overcome but there are some strategies you can try to replace these feelings with a sense of strength and empowerment.

Perhaps lately you’ve been feeling powerless and helpless. Maybe you’ve experienced a devastating loss. Maybe you’re going through a difficult situation, and you feel stuck.

The feeling of powerlessness can lead to anxiety and depression, and cause harm to our body if we keep holding onto it. However, the issue is when we feel powerless, we tend to stay stuck in this state for a long time. We have a belief that “nothing will make a difference”. We are so fixated at our problem that we are blind to the solutions.

There are moments in life when you feel so powerless but not sure what’s the reason. You’re also not sure how to stop it. How to take back your power and sense of control?

Nobody likes that feeling but the first thing you should know is that you shouldn’t feel like a weirdo because of that. Many people feel powerless in some periods of their lives.

This feeling is normal just like any other feeling. You don’t have to be ashamed. Still, it’s not pleasant to live in your skin while feeling powerless. So, it’s good you came here searching for a solution. Review: The Ancient Secret To The Power Of Prayer: https://www.youtube.com/watch?v=tNTsfSRhIPw

The 12 Universal Laws

Maybe you’ve heard of the “Law of Attraction” or “universal laws” before, but what does that refer to—and how can the universal laws help you? We’ve got the answers. The 12 universal laws are thought to help people find peace and spiritual alignment in their lives, regardless of whether they have other specific religious beliefs. Review: Subconscious Awakening – Training Your Subconscious Mind To Get What You Want: https://www.youtube.com/watch?v=weYyrN2hnjU

By utilizing the universal laws, you may even be able to experience more positivity and fulfillment! We consulted happiness coach, intuitive counselor, and psychic Kari Samuels to compile a comprehensive list of all 12 universal laws, plus tips on incorporating them into your life.

The 12 universal laws are believed to be fundamental and unchanging laws that govern the universe—laws first known and acknowledged by ancient cultures.

The laws stem from hermetic philosophy in places like ancient Egypt, but ultimately, they’re so old and widespread that it’s hard to trace their exact origins.

Although they’re not scientifically proven, many people (of varying religions and spiritual beliefs) still use the laws to bring positivity and joy into their lives.

Review 12 Universal Laws: Working with the Law https://www.youtube.com/watch?v=AgbHng3JrQY&list=PLFAKeeiU2C4HA11R-ozdwbCsG6Ds6Xmzh&index=1

Examples of Feeling Powerless and Powerlessness

We all have been through adversities that make us feel powerless and helpless. Before we discuss how to deal with it, here are some common examples of feeling powerless.

Feeling Powerless Over Our Health

It could be we are dealing with a chronic illness or disease, especially those with no cure yet, and we have no say in when we will get better. We can only rely on and trust the medical professionals to help us.

We could also feel powerless over our addictions such as alcohol. It seems like our addictions have control over us and no matter what we do, we can’t quit our habits. Review: Developing Your Healing Consciousness: https://www.youtube.com/watch?v=7NzqJ3oGfkc&t=19s

Feeling Powerless at Work

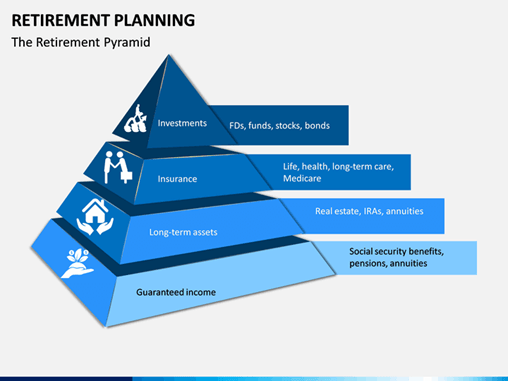

A sudden recession or job or business loss can make us feel helpless, especially if we have not been saving our income and are not financially prepared for it. For those who are entrepreneurs, a change in government policy and regulation can affect our business or income and make us feel powerless too.

Or it could be that we are in a job that we dislike and we think we have no choice but to stay in it. It could also be that we have a controlling employer or management who is not open to listening to our suggestions and ideas.

Feeling Powerless in Relationship

Some of us are stuck in a dysfunctional relationship where there is an imbalance of power. Our partner is demanding and try to control us all the time. We feel like we can’t leave our relationships because we depended on our partner for something such as money and accommodation.

Being ditched instead of a mutual breakup can make us feel powerless over the status of our relationship too. We try to save the relationship but nothing we do helps to change our ex’s mind.

We Can Feel Powerless When We Try to Help Others

Sometimes, it could be that we want to help others but we don’t know how to help them. Other times, it could be that the other person doesn’t wish to be helped by us or they don’t listen to our advice. So we can’t do anything to help them.

Why Do People Feel Powerless?

1. Lack Of Control

Feeling powerless can arise when you feel like you don’t have control over your life or the situations you find yourself in. This can be particularly true if you’re going through a difficult time, such as a breakup, a job loss, a health issue, or the loss of your lovely person. You feel like there’s nothing you can do to change the situation. It often happens in a relationship when you’re unsure about your feelings or decisions.

2. Overwhelmed

Feeling powerless can also come from feeling overwhelmed by the demands of life. This can happen when you have too many responsibilities to juggle or when you feel like you don’t have the resources or support you need to handle the challenges you’re facing.

3. Self-doubt

Feeling powerless can be the result of negative self-talk and self-doubt. When you constantly criticize yourself or doubt your abilities, it can erode your sense of confidence and make you feel powerless to achieve your goals.

4. External Factors

Feeling powerless can also be a result of external factors, such as systemic injustices, discrimination, or inequality. When you feel like the deck is stacked against you, it can be hard to feel like you have any power to make a change.

What Causes Feeling of Powerless?

The first step is to identify the root cause and then, start to act in order to fix it. There’s no sense in scratching the surface but you have to dive into the depth of your mind. If you start to practice fitness, jogging, creative work, or anything like that, you’ll only hide your problems. They won’t be solved completely.

Meaning, you have to analyze your situation and admit to yourself what are the triggers of your powerlessness.

Energy In Disbalance

Every time you pass through a hard period that makes you weaker than before, the energetic layers of your body get imbalanced. And then you have a feeling of powerlessness, a lack of motivation, and you deeply need support because you feel like you can’t do anything alone anymore.

The third, yellow chakra, called the solar plexus, is often responsible for our lack of power. When in balance, it gives us the energy and power to do anything that’s in our plan. It gives us self-confidence and a feeling of control.

Since you feel powerless, your first step should be to balance the solar plexus, as well as other chakras. You can do it with visualizations and the healing music you can find online.

Balanced Nutrition

Don’t forget to recover your body with the substances it needs. After a period of stress, the body lacks vitamin B, zinc, and iron. Check your blood count and consult with your doctor.

Breakup, Loss, Health Problems…

If you’re passing through some events you don’t have control over, you need to reorganize your mind. Before sleep or at any time you can lie down and relax completely, close your eyes and feel your powerlessness. Think about the happenings that made you feel like that.

Then imagine a wheel of fortune. It symbolizes our lives. The truth is nothing is under our full control. There will always be something that doesn’t depend on our actions. Remember and repeat: “I’m not responsible for what’s happening. I don’t have to do anything. I can not do anything.”

Imagine your feeling of powerlessness like a black stain on your body. Now when you realize the happening around you is not under your control, remove the stain. Visualize it disappearing and feel the relief.

Repeat the visualization every day. It will help you to accept the fact that you can’t do anything but it’s not your powerlessness. Everything is as it should be.

Too Busy, Too Little Support

When you’re full of responsibilities, it is normal for you to feel powerless. You can’t do your tasks properly or you make a big effort to do them all and finally get dog-tired, even before you’ve done with all of your tasks.

In that case, reorganize your day. See which tasks can you reschedule or how could you accomplish them faster. Think about if is there something you could delay right now and solve later. Consider also who could help you. We’re often too proud to ask for help. That’s maybe because we feel obliged to those who help us. But remember that you make people feel important when you ask them for help.

Lack Of Self-Esteem

That’s the problem of many people and it inhibits them to do many worthy things they have the capability to do. It’s a psychological issue that should be treated with professional help. A visit to a psychologist is not a bad idea.

If not, try to dive into your subconscious mind to see what caused you to feel less worthy. The easiest way to do it is to look at your dreams. Consider symbols in your dreams and search for their meaning. That may tell you about the triggers of your powerlessness caused by a lack of self-confidence.

Discrimination, Mobbing…

If the trigger is not inside you, sometimes it is outside, around you. When you’re experiencing something you constantly struggle with but with no success, you feel so powerless. And that’s an awful feeling. For example, bearing with mobbing at work can be really terrible. And then you’re trying and trying to come to the end of that but nothing helps. The circumstances work against you. You don’t have evidence against your bullies but you can’t find another job. Ah, so awful.

In that situation, simply give up. Let things happen and wait until something changes. It may seem it’s easier to tell but do, but it’s the only solution at the moment. Learn to keep cool regardless of happening around you. Remember again the situation is not under your control. Accept that you can’t do anything although you’d like you can.

Patience is the key now. It’s hard but that bad times will pass.

When You Feel Powerless and Helpless Use This Secret

“If you abide in me and my words abide in you, ask whatever you wish, and it shall be done for you.”

The verse has two halves, a condition and a result. The condition “If you abide in me, and my words abide in you . . .” the result “then ask whatever you wish, and it will be done for you.”

If we are to have consistent answers to prayer, the words of Jesus must abide in us. That is, as we saw from verses 4 and 5, Jesus himself must abide in us speaking.

We do not just stock ourselves with dead ideas which he spoke once, but we receive and believe and remember and meditate on the truths that he spoke once and is speaking now as he abides in us. Review: HOW TO PRAY FOR ANYTHING | DR. JOSEPH MURPHY: https://www.youtube.com/watch?v=tPLJzomhI3I

The Power of Prayer to Overcome Feelings of Being Powerless and Helpless

There are many times we feel powerless in our lives, especially in the face of difficult circumstances. By ourselves, we can do nothing.

The scriptures confirm this. In John 15:5, Jesus says, “Apart from me you can do nothing.”

We recognize the need for God’s power. This is the same power by which God created the heavens and the Earth. It’s the same power that parted the sea for Moses and that Jesus used to heal the sick and cast out demons.

It was that power that raised Christ from the dead and brought a baptism of fire on the first Christians.

All these miracles happened through the power of prayer. Moses prayed before Yahweh. Jesus prayed to the Father for miracles. The early Christians prayed together in the Upper Room.

Whether it was Daniel in the lion’s den or Elijah before the false prophets, prayer constantly served the important figures of the Bible. And we can harness that same power in our lives today.

God gives us this power through His Holy Spirit.

Paul tells the Ephesians in 1:18-19:

“I pray that the God of our Lord Jesus Christ, the Father of glory, may give you a spirit of wisdom and revelation as you come to know Him …and what is the immeasurable greatness of His power for us who believe, according to the working of His great power.”

Our Heavenly Father gives us this power through His son Jesus. There is power in Jesus’s name.

In John 14:13, Jesus says:

“I will do whatever you ask in my name, so that the Father may be glorified in the Son.”

Why Prayer Works to Overcome Feelings of Feeling Being Powerless and Helpless

Prayer works because God wants our complete dependence on Him. He wants us to recognize that without Him, we can’t transcend our limitations.

God is the source of our fulfillment. He is and wants us to make Him the answer to our longings. Prayer draws us into a deep relationship with God.

Our prayer life brings us closer to Him through honest communication, just as any child does with their parents.

What Does Prayer Achieve and Overcome When You Have Feelings of Being Powerless and Helpless?

Prayer changes us first. In our busy lives, too often, we don’t pray enough. Or we pray for our most pressing needs and treat God as a genie.

Deep, intimate prayer draws us close to the heart of God. It helps us become more like Him. Prayer lets us hear the Father’s voice and direction. It inspires us and gives us answers. It reveals our flaws and perfects us. It is an avenue by which we can repent and be forgiven for our sins.

As we share our deepest longings with God, we change and become the people God wants us to be.

Collective Prayer Helps to Overcome Feelings of Being Powerless and Helpless

Jesus Christ Himself teaches us the power of collective prayer.

In Matthew 18:19, Jesus says:

“If two of you agree on Earth about anything you ask, it will be done for you by my Father in heaven.”

He even gives the template of the “Our Father,” or “The Lord’s Prayer,” to show us how we must pray.

Faith in collective prayer is encouraged. Throughout the Old Testament, collective prayer is demonstrated — in some cases, even national prayer is depicted. In scripture, God lays out specific guidelines for the Passover for the nation of Israel and the Ark of the Covenant.

In James 5, Christians are encouraged to pray with and for each other in times of sickness and suffering.

Scriptures About the Power of Prayer to Overcome Feelings of Being Powerless and Helpless

The Holy Bible has numerous scriptures and stories about the power of prayer and how it works in people’s lives.

Hannah’s powerful prayer in 1 Samuel is a good example of how this power works. Hannah was married to Elkanah, who loved her deeply. However, Hannah was barren.

In her story, her deep longing for a child drove her to despair. She cried out to God in prayer to bless her, and He did.

The birth of the prophet Samuel made Hannah sing a beautiful song of praise in response to the answered prayer. Her story demonstrates the Lord God’s omnipotence and how He does hear us when we pray — and He loves us.

Why Is It Necessary To Be Righteous to Overcome Feelings of Being Powerless and Helpless?

God hears our prayer requests, and God answers them, too. He is a holy God and wants us to strive to be like Him.

In Matthew 5:48, Jesus explicitly asks us to be perfect like the Heavenly Father is perfect.

Prayer can help us have the strength and power to be righteous. Through righteousness and the grace of God, we are able to use the power of prayer in every aspect of our lives.

God asks us to abide in Him through our Bible and prayer life, and we can ask Him for anything that is good. If we don’t abide by God’s word and follow His precepts, then we are powerless.

“The prayer of the righteous is powerful and effective” (James 5:16).

When Having Feelings of Being Powerless and Helpless Are You Open to God’s Will?

While God will always answer our prayers, He may not answer them in a way we expect or think is best. But we must trust the Lord God’s will, for He truly knows what is best for us.

We should spend time trusting and understanding God’s plan for us. When we do, we can be sure God listens to us.

God’s power is too precious to let loose on a soul that is not open to God’s will. Jesus repeatedly asks and prays for God to be glorified. We should do the same.

When You Are Trying to Overcome Feelings of Being Powerless and Helpless Are You Using the Power of Prayer

There is probably no religious practice so generally accepted yet so little understood as prayer.

Every person you meet will tell you he has received an answer to prayer.

Regardless of caste, nationality, color or creed, all men have experienced that definite sequence of request and fulfillment described as prayer.

A man prays for money and the postman brings him the needed amount; a woman prays for food and food is brought to her door. But on the other hand there is the evidence of prayers apparently unanswered, of hungry people starving to death, of the child which dies in spite of its parents’ most passionate appeals to God. Is there an ancient secret to this practice that help make our prayers come true.

The Rosicrucians believed that there was an art to prayer and taught specific techniques to their students for this practice Any study of prayer will reveal contradictions and many facts which are strange and puzzling.

A trivial prayer meets with an answer while one on an important matter fails; a simple ailment is relieved while an agonized petition to save a beloved life meets with no response.

A devout person will say, “It is the will of God” and question no further, but the Rosicrucians are not content with this. As esoteric students, they realize that in prayer certain laws are at work, laws which must be discovered, identified and understood.

To Overcome Feelings of Being Powerless and Helpless You Must Know You Are Prosperous and Abundant

You have this amazing power and using my words I tap into an incredible power of your imagination to create prosperity within you. Let me guide you with imagery and words to awaken prosperity in your life Prosperity is the sunrise on the horizon of your ambitions, its rays reaching out to touch every facet of your being.

It is the warmth that bathes your spirit in comfort, the light that illuminates your path to greatness. This abundance is an orchestra, each note resonating in harmony with your deepest desires, composing a symphony not just of wealth, but of well being, passion, and purpose. Review: You Are Prosperous AF: https://www.youtube.com/watch?v=ETgecJ1Ifm4

Prayer Techniques to Overcome Feelings of Being Powerless and Helpless

This is a fairly comprehensive list of practical techniques that Dr. Joseph Murphy teaches in using your imagination and prayer to see your wishes fulfilled. When we come to analyze prayer, there are many different approaches or methods.

We will not consider the formal, ritual prayers used in religious services. These have an important place in group worship. We are immediately concerned with the methods of personal prayer for use in your daily life and in helping others.

Prayer is the formulation of an idea concerning something we wish to accomplish. Circumstances and individuals suggest different approaches, but all must establish a clear statement of the benefit, the healing, and the purpose for which the prayer is offered.

The techniques Murphy covered are the visualization method, the mental movie method, visualization technique for an audience, the Baudoin technique, the sleeping technique, the thank you technique, the argumentative technique, soundwave therapy, the decree method and the secret place. These are just a few of the unique tools Murphy gives that you can use to see your wishes fulfilled. Review: Joseph Murphy – Techniques Of Prayer: https://www.youtube.com/watch?v=u_fR8bjEVgE

The Art of Believing in God to Overcome Feelings of Being Powerless and Helpless

Neville Goddard believed that prayer is the master key. A key may fit one door of a house, but when it fits all doors it may well claim to be a master key. Such and no less a key is prayer to all earthly problems.

In this, Neville explains how prayer works. You must believe you already have what you are praying for. To do this, try to feel it. How would you feel if you already had what you wanted? Try it, and see. Review: Prayer: The Art Of Believing By Neville Goddard: https://www.youtube.com/watch?v=H1nr5SK_wq4

The Forgotten Art Of Prayer to Overcome Feelings of Being Powerless and Helpless

The “call to prayer” is heard in all languages, by innumerable religions the world over. “Pray about it” is common advice to the troubled heart. “Prayer changes things” and “the family that prays together stays together” are popular slogans stressing the importance of prayer.

But what do we mean by prayer? The word “prayer” has no absolute meaning in our day. It means one thing to the child who says, “Now I lay me down to sleep.” It means something entirely different to the person who says his “Our Fathers” unthinkingly in a monotonous drone.

It means one thing to the person who sits quietly under the trees in a wordless adoration of life and nature and with a receptivity to the “still small voice” of Spirit. It means another thing to the congregation of the preacher who gives a twenty-minute prayer that is eloquent and studied, and that touches every area of human need.

A study of all the prayer practices within the Christian family of denominations is interesting and revealing. It is also a commentary on how far traditional Christianity has strayed from the teachings of Jesus. We find prayers of flattery, expecting a vain God to be moved by praise.

There are prayers of pleading and supplication, for coaxing a miracle from a reluctant God. There are prayers of vain repetition, where the asker hopes that if he prays long and loudly enough, an apparently inattentive God may hear and respond.

It is amazing that so few have really understood or paid any heed to the new technique of prayer that Jesus brought to the world. He shows that prayer is susceptible of being reduced to intelligible postulates that may be unquestionably proved in practice.

He indicated that the principles of prayer are universally applicable in all places, at all times, and for all persons. Prayer does not deal with a capricious God. It is a technique for achieving unity with God and His limitless life, substance, and intelligence. Review: Eric Butterworth – The Forgotten Art Of Prayer: https://www.youtube.com/watch?v=yEvFnJs3ubY

How To Use The Power Of Prayer to Overcome Feelings of Being Powerless and Helpless

This short little book is a powerful explanation of how to use the power of prayer by the amazing writer and metaphysician Joseph Murphy. You may not entirely agree with some of his definitions of the universe.

To believe is to accept something as true. To make alive the truths of God by feeling the reality of them in your heart. Belief makes the difference between success and failure, riches and poverty, health and sickness.

Through the study and application of prayer and believing, you can find the way to health, harmony, peace, and prosperity; scientific prayer is the practice of the Presence of God.

This book has easy tools to apply to your life. Powerful clear and user friendly! How to use prayer and thoughts to manage your life. Review: How To Use The Power Of Prayer By Dr Joseph Murphy: https://www.youtube.com/watch?v=wQiXb4TNmsU

Teaching You How To Pray to Overcome Feelings of Being Powerless and Helpless

Tonight it is “Teach Us to Pray.” You’ll find this the most practical evening. We’re told he was praying in a certain place; but when he ceased one of his disciples said to him, “Lord, teach us to pray.”

Then he tells a story…he told them a parable to the effect that we ought always to pray and not lose heart. Then he tells the parable: “In a certain city there was a judge who neither feared God nor regarded man; and in that city there was a widow who came to him constantly and said to him, ‘Vindicate me against my adversaries.’

And although he did not fear God nor regard man, he said to himself, ‘I will vindicate her because she comes constantly and she bothers me, and by her continual coming she’ll wear me out’” (Luke 18:3). So we see in this parable the central jet of truth is persistence.

Anyone can learn a prayer, but it won’t be effective. You can learn all the prayers in the world and they will not in any way produce the result you seek. Effective prayer, in the real sense, is an art; and to learn an art always requires a careful method and persistent practice. Review: Neville Goddard Teach Us To Pray: https://www.youtube.com/watch?v=ZMBrchHcgpo&t=24s

The Secret Of Praying to Overcome Feelings of Being Powerless and Helpless

He who has learned how to pray has learned the greatest secret of a full and happy life. You’re told in scripture that his followers said to him, “Lord, teach us to pray.” He gave him a prayer (Luke 11:1).

But that is not teaching man how to pray. So we’re told in other passages that he told it in the form of a parable, “And he told them a parable that they ought always to pray and not lose heart.”

Then he told the story of persistency. “There was a judge and he neither feared God nor regarded man. In that city there was a widow and she came to him and asked him to exonerate her, that these enemies of hers were persistent. At first he did not respond, but then he said to himself, ‘Although I neither fear God nor regard man, yet I will exonerate her, because by her much coming she bothers me and she’ll wear me out’” (Luke 18:3).

And so all parable is like a dream. Every dream has a single jet of truth, so when you read the story we see the necessity of persistency in prayer until you master it. When you master it, the most effective prayer in the world is “Thank you, Father,” the most effective prayer in the world, after mastery. But until mastery then there is a technique.

And persistency is like an art. You must practice any art in this world. First you must find a good method and try to find the best method. When you’ve found it, then it requires daily practice, any art in this world.

If you don’t practice, well, then you become rusty. So find a good method first and then practice. Review: Neville Goddard The Secret Of Praying: https://www.youtube.com/watch?v=rHZIKZFRLkg&t=

Guided Meditation Hermes Immortality Prayer

This meditation is designed around an amazing prayer given in the Hermetica as written by Hermes. This is an amazing and powerful prayer Below is a portion I pray that the Cosmos be flung open to me and that all nature may receive the sound of my psalms.

Open, great earth, and trees, silence your waving boughs, for I am about to sing the praise of the One and All. Justice, praise the just through me. Goodness, praise the good through me.

Truth, praise the true through me. Selflessness, praise the All through me. It is your words that through me sing your praises — for all comes from you and all returns to you.

Accept these pure offerings of speech from a heart and soul uplifted. You of whom no words can tell, no tongue can speak, and only silence can declare. I thank you with a brimming heart, for it is only by your grace that I see your Light and come to know you. I thank you whose name no man knows. Review: Guided Meditation Hermes Immortality Prayer: https://www.youtube.com/watch?v=oQBQ1mt0UF8

The Lord’s Prayer An Interpretation When Having to Overcome Feeling of Being Powerless and Helpless

Our Father, who art in heaven, hallowed by thy name, thy kingdom come, thy will be done, on earth as it is in heaven, give us this day our daily bread and forgive us our trespasses and lead us not into temptation but deliver us from evil for thy is the kingdom, the power and the glory forever. Amen The Lord’s prayer is perhaps the most famous of all prayers.

This powerful collection of phrases has been used for thousands of years as the penultimate prayer. I memorized this as a child and have said it hundreds of times even when I did not believe.

Is there a deeper meaning to the lord’s prayer? Emmet Fox the classic metaphysicist breaks down the prayers’ meaning and its power. Review: The Lord’s Prayer An Interpretation By Emmet Fox: https://www.youtube.com/watch?v=igDKleFfbgQ

Morning Meditation and Morning Prayer to Overcome Feelings of Being Powerless and Helpless

From The Divine Iliad, join me for this powerful Morning Prayer. Walter Russell’s Morning Prayer The dawn telleth the coming of the new day.

I turn my eyes to the morning and purge myself in the purity of the dawn. My Soul quickeneth with the beauty of the dawn.

Today is, and will be. Yesterday was, and has been. My yesterday is what I made it. I see it in memory, perfect or imperfect. My today is what I will to make it. I will to make it perfect.

I am man. I have free right to choose. I may do as I will to do. I have the power to build the day or to rend the day. The day will be of my making, either perfect or imperfect, good or bad as I choose to live it in spirit or in flesh, on the mountain top or earthbound.

The day is of my choosing. None shall stay my hand in the making of the day. The Universal One will not allow this day to go unlived to the glory of Him whom I am nor to the fulfillment of His command, nor to the fulfillment of His purposes.

If I build the day I will have lived the day to the glory of the One in the fulfillment of that part of His purpose which is mine to fulfill. So that I may meet the day with knowledge to build the day, I will look into my Soul while it is yet dawn, before the morning breaketh. These are the words with which I greet the day.

These are words of the morning. Review: Morning Meditation The Walter Russell Morning Prayer :https://www.youtube.com/watch?v=gvKwyc6UdEg&t=43s

Answered to Your Prayer When You Want to Overcome Feelings of Powerless and Helpless

Have you ever had a prayer answered? What wouldn’t men give just to feel certain that when they pray, something definite would happen. For this reason, I would like to take a little time to see why it is that some prayers are answered and some apparently fall on dry ground.

“When ye pray, believe that ye receive, and ye shall receive.” Believe that ye receive – is the condition imposed upon man. Unless we believe that we receive, our prayer will not be answered.

A prayer – granted – implies that something is done in consequence of the prayer which otherwise would not have been done. Therefore, the one who prays is the spring of action – the directing mind – and the one who grants the prayer. Such responsibility man refuses to assume, for responsibility it seems, is mankind’s invisible nightmare.

The whole natural world is built on law. Yet, between prayer and its answer we see no such relation. We feel that God may answer or ignore our prayer, that our prayer may hit the mark or may miss it. The mind is still unwilling to admit that God subjects Himself to His own laws.

How many people believe that there is, between prayer and its answer, a relation of cause and effect? Review: Neville Goddard Answered Prayer: https://www.youtube.com/watch?v=LLsNgpmNtFI

The Secret Of Prayer When You Want to Overcome Feelings of Being Powerless and Helpless

Today we wish to supplement everything we have told you about meditation — or communion with God — and talk to you about prayer, which is the desire basis of meditation and out of which meditation grew.

Prayer is the mightiest of man’s powers, for through prayer — if understood and rightly used, and accompanied by action — man may have anything he desires, attain the loftiest heights, or extend his powers to others for their exaltation.

Rightly and knowingly used, prayer can transform one’s own condition or that of the whole world. If prayer is not rightly and knowingly used, the time consumed is wasted, for it will be of no avail.

PRAYER IS BASED UPON DESIRE “Desire ye what ye will and, behold, it standeth before thee. Throughout the aeons it has been thine without thy knowing, e’en though thou has but just asked for it.

“Sit thou not and ask, acting not, for unless thou reach out for thy desire it shall not walk thy way to thee unaided by thy strong arms.” (From: The Message of the Divine Iliad)

This means that God will fulfill your every desire if you work with God to fulfill it. The whole power of the universe will work WITH you for its fulfilling, but it will not work FOR you while you do nothing about it.

In this promise is the key to why prayers are or are not answered. God tells you very plainly that He will give you whatever you desire, but you must regive equally by the action of service to God through Nature or your fellow- man. Review: Walter and Lao Russell – The Secret Of Prayer: https://www.youtube.com/watch?v=GE3fY42yoPE

Want More Ways We Help You to Overcome Your Feelings of Powerless and Helpless Contact us Now!

Things that we can help you with that are within your power to control your feelings include:

- Your thoughts

- The way you talk to yourself

- Your priorities

- How you spend your time

- How you take care of yourself

- How you treat other people

- The time you spend with other people

- The coping mechanisms you use to manage stress

- How much you pay attention to the world around you

- How much time you spend on social media

Focusing on the things that you can control about a situation can help you feel less helpless and more empowered.

Contact us for a Free-Guaranteed-Proven Discovery and Coaching Session in MKS Master Key Coaching Program that Can Turn Your Life Around

Reitenbach-Kissinger

Sydney Reitenbach and Michael Kissinger

Text: 650-515-7545

Email: mjkkissinger@yahoo.com

PS. Religious Business owners and entrepreneurs are well positioned to build their wealth and get rich, however we’re not talking about a how to get rich quick scheme. The best way to invest your money is the way that works best for God and you.

PPS. Develop Your Healing Consciousness Now!

Together let us dwell upon these great truths of the Bible:

“I am the Lord that healeth thee. If thou return to the Almighty, thou shall be built up. The Lord will perfect that which concerneth me. Behold, I am the Lord, the God of all flesh. Is there anything too hard for me?

I will restore health into thee, and I will heal thee of thy wounds, sayeth the Lord. Who healeth all thy disease? Who satisfy thy mouth with good things? Who restored thy youth like an eagle?

There is only one healing power. It is called by many names, such as God, infinite healing presence, divine love, divine providence, nature, the miraculous healing power, the life principle, and many others.

This knowledge reaches back into the dim recesses of the past. An inscription has been found written over ancient temples that reads, “The doctor dresses the wound, and God heals it.”

The healing presence of God is within you. No psychologist, minister, doctor, surgeon, priest, or psychiatrist heals anyone. For example, the surgeon removes a tumor, thereby removing the block and making way for the healing power of God to restore you.

This infinite healing presence of life has been called the Father in the Bible. It is the healing agent in all diseases, whether mental, emotional, or physical. The miraculous healing power in your subconscious mind is scientifically directed. It can heal your mind, body, affairs of all disease and impediments, when it is scientifically, consciously, and knowingly directed.

Review: Bible Mystery and Bible Meaning, Thomas Troward

Giving Voice to the Wisdom of the Ages (backup) · Playlist

Review: THE SCIENCE OF MIND | FULL AUDIOBOOK | DR. ERNEST HOLMES

Review: MKS Master Key Challenge mksmasterkeycoaching.com

Review: MKS Master Key Testimonials https://lnkd.in/gMS7XUg8

Review: Shocking Revelations on Universal Metaphysics – Saint Germain: https://www.youtube.com/watch?v=qFRUw7TIgJU