You’ll Get Your Desired Results with Confidential-Insured and Bonded Common Sense-No BS-High Performance Life, Executive-Business-Financial World Class Coaching

Our vision is to significantly improve the quality of lives and businesses globally by elevating the quality of thoughts individually.

We do this by educating, mentoring, coaching and empowering our audience through coaching, mentoring, teaching, products, services and events that expand awareness and harmonize people with the spiritual, natural, immutable Laws of the Universe.

We intend to play a significant role in creating a world in which true wealth—spiritual, material, intellectual—flows to, through and from every person in an ever-expanding, never-ending cycle of prosperity and abundance.

Request the Services of the Reitenbach-Kissinger Institute, Michael Kissinger, or Best Selling MKS Master Key Factor, Formula, Coaching and Systems.

We believe that most people never realize their full potential because they simply don’t understand the proper way to think and use the powers of their mind. You see, when we work in harmony with Spiritual, Universal and Material Laws, we move beyond perceived limitations and can literally think our way into any result we desire, and live the life that we really, really want.

We’ve Helped Thousands Generate Millions with Proven Life, Business and Leadership Development Coaching Based on the Principle of

There is a science of getting rich, and it is an exact science, like algebra or arithmetic. There are certain laws which govern the process of acquiring riches, and once these laws are learned and obeyed by anyone, that person will get rich with mathematical certainty.”

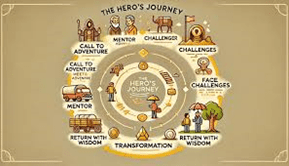

Ready for The Hero’s Journey of Self-Discovery by Joseph Campbell – The Hero’s Journey examines the questions: How can you live a meaningful life? What is the deepest life you are called to, and how can you respond to that call.

Discover your calling and how to embark on the path of learning and transformation that will reconnect you with your spirit, change negative beliefs and habits, heal emotional wounds and physical symptoms, deepen intimacy, and improve self-image and self-love.

Along this path we inevitably meet challenges and confronting these challenges forces us to develop and think in new ways and push us outside our comfort zone. Reitenbach-Kissinger Institute focuses our Personal coaching, and training on:

The Bible: Foundational principles that God is the source of everything. He owns it all. We are just managers! Everything we have, and everything we are, represent His gifts entrusted to us. These concepts are so foreign to our normal thinking that it may seem limiting, but it is really liberating.

Andrew Carnegie: The first billionaire challenged Napoleon Hill to interview the world’s most successful people in order to create a simple formula that anyone can follow in order to achieve success and become wealthy.

As a Man Thinketh by James Allen: Your own thoughts shape your character, circumstance, and destiny. Controlling of your thoughts liberates you from undesirable experiences. There is no better prescription than the mastery over the mind. Each man holds the key to every condition, good or bad, that enters into his life. By working patiently and intelligently upon his thoughts, he may remake his life, and transform his circumstances.

Master Key System by Charles F. Haanel: Get ready to dive into one of the most valuable and foundational books of our time concerning the Law of Attraction and the art of visualization. Unlock, discover, and explore the world within and the power of thought as you learn and experience real life.

The Science Of Getting Rich by Wallace D. Wattles: Has inspired countless individuals to achieve wealth and prosperity through the power of thought, will, and action. This is a simple coaching is dedicated to the principles of achievement. Change your life by changing your thoughts.

“Think and Grow Rich by Napoleon Hill: Draws on stories of Andrew Carnegie, Thomas Edison, Henry Ford, Bill Gates, Mary Kay Ash, Dave Thomas, and Sir John Templeton and other contemporary millionaires and billionaires of his generation to illustrate his principles of wealth.

The Success System That Never Fails by W. Clement Stone: The key to Stone’s success is — The System. The key components of the success systems that never fails are (1) inspiration to action; (2) know how; and (3) activity knowledge.

Working The Law by Raymond Holliwell – Explores the profound connection between individuals and universal laws governing success and prosperity

The Biblical Millionaire System that Never Fails by Michael Kissinger– Explores How the Millionaires of Genesis, Moses, Joshua, Nazareth and Other People Became Rich?

You Were Born Rich by Bob Proctor. Explores the transformative power of “Thinking into Results.” This transformational coaching provides proven strategies to unleash your mind’s potential and create lasting success.

The 30 Day Mental Diet by U.S. Andersen Argues the physical world is derived from the mental. That a sustained mental image, if backed by faith (i.e. a belief that the image is real, or will become real), will become reality.

Tap into your unlimited potential and design the future you desire.

Get started today.

COACHING AREAS INCLUDE:

- Achievement * Business * Finance * Healthy Living * Mind & Body* Marketing * Mind Tech * Motivational * Personal Development * Relationships * Skill Building * Sales Training * Spiritual Growth * Wealth Building * Wellness *

It is Your Move!

Get A FREE Caching Assessment Session That Can Add Thousands to Your Life or Business Almost Immediately! Call 650-515-7545

Reitenbach-Kissinger Institute Summary

WHO WE ARE:

We don’t just coach, mentor or teach others how to think their way into the results they want, we live it in our own lives. We think and dream big—stretching ourselves to limits beyond what we think we are capable of. This fuels our employee’s growth, happiness and abundance.

And we adhere to a daily checklist in our work each day—be grateful, maintain a positive attitude, work in a spirit of creativity and harmony, be a great example of what we sell, and do a better job today than yesterday.

As a company we set big revenue goals so we can continue to increase the impact our work has in the world.

WHAT WE DO

After nearly 20 years of extensive study with world class experts, we found the answer: We had to change our paradigms to optimize health, wealth or success .

Paradigms are a multitude of habits that govern every move we make. They govern our communication, our work habits, our successes and our failures. Negative and faulty paradigms are why ninety-some percent of the population keeps getting the same results, year in and year out.

Using more than 40 years of research, study and direct application, we coach, mentor and teach people how to do what one of our Mentors and Coach Bob Proctor did: changed our paradigm so we can get desirable results and enjoy life more fully.

Each day, we continue to study and to create so we can continue to offer the most practical ways to continue to develop the extraordinary power of the mind.

Understanding Proceeds Change

We at the Reitenbach-Kissinger Institute, believe most people want to earn more money, have more fun and enjoy their days more. But we know it won’t happen by accident.

Our coaching. mentoring and teachings are built on the premise that we have a power flowing in and through us that is far superior to any condition or circumstance around us.

We show our audience how to use their thoughts to direct this power to achieve whatever results they choose in this lifetime.

What’s Keeping You from Taking the Next Step?

You may be closer to success than you think.

Reitenbach-Kissinger Institute Life and Business Coaching Program Summary

Do you have an idea for an amazing life or service but you aren’t sure how to build a life or business around it? Then you NEED this coaching.

Are you a current employee who struggles to identify your career and deliver true world-class value?

Everything you need to know is included in this coaching and training!

Do you want to build your business into a fully-fledged venture that will help you build the life or business you deserve? Then you NEED this coaching.

How Confident Are You About Your Life or Business or Financial Future? Feel Like You’re Working Hard but Your Bank Account Doesn’t Reflect It? Then you NEED this coaching.

Get Guaranteed Results

With over forty+/- years of firsthand experience working with entrepreneurs, new ventures, and high-growth startups, we have the answers.

We concisely present the core fundamentals that all new and experienced entrepreneurs need to know to get started, find success, and live the life of their dreams.

Business and entrepreneurship students, small business owners, managers, and soon-to-be entrepreneurs will all find a wealth of value with this coaching.

From the very first steps conceptualizing your venture to winning your first customers, delivering value, and turning a profit, this coaching acts as an invaluable blueprint for your path to entrepreneurial success.

Our extensive experience, and easy-to-understand coaching come together to make this coaching and teaching a must-have resource for every budding entrepreneur or business owner!

Reitenbach-Kissinger Institute Business Coaching is Perfect For

- Would-Be Entrepreneurs With a Ton of Passion!

- Entrepreneurial Students of All Ages!

- Beginners with Zero Prior Experience!

- Managers, Business Owners, and Decisions Makers Growing into a New Role!

Reitenbach-Kissinger Institute Business Coaching Covers

- The Difference Between an Idea and an Opportunity!

- What Makes an Entrepreneurial Opportunity Great!

- The Very First Steps You Need To Take To Get Your Venture Off The Ground!

- Pricing, Competition, Customer Identification, Marketing.

- The REAL Components of an Entrepreneurial Mindset!

- Exactly How To Craft Your Value Proposition!

- How to Write a Comprehensive Business Plan!

- Profit Optimization

Michael Kissinger Founder and Coaching Experience Summary

SUMMARY * EXPERIENCE * SKILLS * REFERENCES * EDUCATION * CONTACT US

WHO MICHAEL KISSINGER IS:

Michael Kissinger is a Founder, Owner with Grand Master Sydney Reitenbach. He is a Personal, Life, Business Development and Leadership Coach with over 40+ Years Experience, helping people find their places in this great world.

His Major Characteristics Are: Experiences, Client First Mindset, Analytical Skills, Reliable in Word and Deeds, Excellent Listener, Lifelong Learner, Driven, Natural Influencer, Intuitive Communicator, Detailed Oriented, Emotional Intelligence.

He works hard every day to help people recognize their potential, achieve their goals, dreams and enhance their lives or businesses.

His coaching has become a vital tool for businesses today, with 86% of companies reporting positive ROI from business coaching. This highlights how coaching is no longer a luxury—it’s an essential part of business growth.

He helps leaders scale their businesses or overcome operational hurdles. His business coaching plays a critical role in driving long-term success. He guides leaders through challenges, enables them to make better decisions and stay focused on their goals.

His coaching isn’t just for struggling companies; it’s for growth-driven leaders who want to maximize their impact and results.

His business coaching is a dynamic and a collaborative partnership where he works closely with business owners and entrepreneurs to help them define goals, create actionable strategies, and overcome business challenges.

He empowers you to think strategically, enhance leadership skills, and holds you accountable for achieving your vision.

He focuses on five key areas: leadership development, strategic planning, team performance, accountability and your profitability. He does not just offer advice; he unlock your potential and transform your business from the inside out.

He helps clients navigate challenges, identify opportunities, and stay focused on what matters most. Whether it’s helping you break through a tough business decision or supporting you in doubling you revenue. These wins aren’t accidental—they’re the result of his solid coaching strategy.

As your coach, his role is to foster growth, provide fresh perspectives, and ensure you stay on track to meet your goals, making him an indispensable asset for long-term success.

WHAT MICHAEL KISSINGER DOES

Kissinger‘s Core Responsibilities

- Strategic planning and vision setting

- Leadership development and team empowerment

- Financial and operational efficiency

Do you want the opportunity to bring your dreams to fruition, change your life, business, career, obtain your degree, or learn a new skill? Let me walk this journey with you as you activate your skills and begin to release your fears.

Your gifts, talents and life experiences exist to support your personal successes. The missing ingredient is your own Personal, Life and Business Development Coach development coach.

Kissinger‘s Coaching Step-by-Step Process

- Initial assessment and goal-setting

- Customized coaching plans and regular sessions

- Tracking progress and adjusting strategies

Client Benefits from Kissinger‘s Coaching

- Improved decision-making and strategic thinking

- Accountability and goal achievement

- Enhanced leadership and communication skills

- Accelerated business growth and performance

- Better work-life balance

- Let’s get started today with your free Personal, Life or Business Development Coaching evaluation! Call us at 650-515-7545.

Kissinger‘s Coaching Method

He offers Dynamic Coaching – A unique method to achieving personal, business, career, financial or leadership success. It combines theories of our most popular coaches, mentors, authors and the power of their programs with the knowledge, experience, and professionalism.

He eliminates most problems or challenges clients face in their life or businesses which included a severe cash flow crunches, quickly accelerating material costs, employees duplicating work and software programs and etc. through analysis, coaching, mentoring or consulting

His approach to coaching is unique and is guaranteed to help you achieve your personal, business, career, financial or leadership goals. The combination of these elements provides … direction … confidence … focus page This coaching is designed to propel you to the next level of success.

His coaching programs and workshops are designed to address your specific areas of personal, business, career, financial or leadership and are based on customer requests and expressed interests:

Kissinger‘s Life, Business, Financial and Leadership Coaching Focus Provides

* Coaching with over Forty Years Experience.

* The highest quality, most informative, and mind blowing coaching.

* Secrets of life, business, wealth and success hidden in plain sight

* Ancient wisdom, physics, and faith intertwine for success

* Mindset shifts that all successful people share

* Amazing coaching culled from the success experiences of many of his and the world’s most powerful and wealthy men.

* Timeless solutions that have helped thousands of people generate millions

* Let us conquer your dreams together. Whether you are a beginner seeking solid foundations or an experienced entrepreneurs looking to optimize your gains join the community and embark on the journey toward personal, business, and financial success.

KISSINGER’S EMPLOYMENT AND WORKING EXPERIENCE SUMMARY

Managing Director at Reitenbeach Institute of Tae Kwon Do

Founder and Owner-Sydney Reitenbach is a Kukkiwon Certified 7th Degree Black Belt and University of San Francisco Adjunct Professor teaching Taekwondo in the Kinesiology Department for over 40 years. Helped get Taekwondo in the 1988 Olympics.

- Michael Kissinger is a Kukkiwon Certified 4th Degree Black Belt TKD Instructor of health, wellness and fitness expert who helps men, women, and children lose weight, get fit, and feel years younger.

- They provide comprehensive Taekwondo training for all ages. From young children needing help with confidence and discipline to adults looking for fun, fitness, and stress relief,

- They offers a variety of classes and programs for improving self-esteem, learning respect and discipline, and developing a healthy body and a healthy mind.

- Students will learn the same taekwondo techniques and styles practiced by the World Taekwondo Federation and Olympic taekwondo competitors. It offers students the opportunity to better themselves through martial arts nd Universal Laws.

- They provide Olympic Championship Style Group & Private Tae Kwon Do Instruction for Children, Adults & Seniors

- They Provide Instruction on the Secrets to Winning Big in Martial Arts Programs. Includes:

* Basic Tae Kwon Do, Health & Fitness

* Academic Leadership Programs

* Anti-Bullying School & Work Programs

* Street Smart-Self-Defense Programs

* Nutrition and Weight Programs and

* Much More!

Business Development Director at Swords to Plowshares

1060 Howard Street, San Francisco, Ca

He is an Honorably Discharged 10th Special Forces Member. He also has two sons who were Honorably Discharged from the US Navy. His duties included but were not limited to: Meeting with public agencies to create and developed employment for US Military Veteran

Developed relationships with US Military bases and National Guard units so returning veterans could go to work in various industries. Developed relationships with contractor associations and have contractors hire US Military Veterans.

Meeting with veteran friendly small businesses who agreed to hire US Military Veterans. Advising and creating the development of new business relationships with companies willing to hire US Military veterans.

Showed business owners how they could get substantial profit increases as a result of hiring US Military Veterans. Increase in their sales, revenues, and profits.

Creating outreach strategy and systems for getting US Military Veterans hired quickly. Provided strategic consulting, including business outreach plans & outreach strategy development for putting US Military Veterans to work.

Gave on-site and off-site trainings to employees, veterans and business owners to meet their profit goals as shown on Channel 29 and You Tube.

Business Development Director at Vietnam Veterans of California

VA in Menlo Park, California

Meeting with public agencies to establish the Vietnam Veterans of California office in Menlo Park, California. Created and Developed Training Program by working with local San Francisco Bay Area colleges.

He developed relationships with US Military bases and National Guard units so returning veterans could go to work in various industries industry. Developed relationships with contractor associations and contractors to hire US Military Veterans.

Meeting with veteran friendly small businesses who agreed to hire US Military Veterans. Advising and creating the development of new business relationships with companies willing to hire US Military veterans.

Showed them how they could get substantial profit increases as a result of hiring US Military Veterans. Increase in their sales, revenues, and profits. Creating outreach strategy and systems for getting US Military Veterans hired quickly. Provided strategic consulting, including business outreach plans & outreach strategy development for putting US Military Veterans to work.

Gave on-site and off-site trainings to veterans and business owners to meet their profit goals. Shown on Channel 29 and You Tube.

KISSINGER’S UNIVERSITY TEACHING EXPERIENCE

SAN FRANCISCO STATE UNIVERSITY TEACHING EXPERIENCE Adjunct Professor-17 Years Experience

At San Francisco State University, Golden Gate University and Canada College. Adjunct Professor Personal, Life and Business Development Coach, Seminar Speaking, Coach, Mentor and Consultant

All of the duties related to Personal Development Coach, Seminar Speaking, Mentoring, Coaching, Consulting duties were applied to my work with my students in the Adult Continuing Education Programs.

As an Adjunct Professor and Personal, Life and Business Development Coach I instructed adult students in the

San Francisco State University, Golden Gate University and Canada College Adult Education programs.

San Francisco Bay Area locations. I taught at the San Francisco State University, Golden Gate University and Canada College Programs in the Workplace courses.

Students were 23+/- years and older in San Francisco State University, Golden Gate University and Canada College Programs higher learning cohorts in order to complete their bachelors, masters or PH.D degree or certificates by attending classes one night a week.

MINISTRY EXPERIENCE– A Minister With Years Experience

Unity Community Church-San Francisco-14 Years Service

As a Lay Minister he did Sunday Readings and conducted various religions services. Helped men and women to become devoted followers of Jesus Christ.

.

St. Stevens Catholic Church-San Francisco Lay Minister-13 Years Service

As a Lay Minister he did Sunday Readings and conducted various religions services. Helped men and women to become devoted followers of Jesus Christ.

Kissinger’s Business and Life Skills

University Teaching · Organization Skills · Problem Solving · Customer Service · Strategic Thinking · Business Development · Working with Senior Citizens · Construction Management · Team Building · Teamwork · Social Entrepreneurship · Public Speaking · Creative Problem Solving · Business Management · Recruiting · Lifestyle Coaching · Construction · Customer Satisfaction, Public Speaking, Leadership Development

Kissinger’s Confidential Testimonials

He helped build a national coaching business that did $100 million annually. This consulting service provided services to businesses throughout the U.S. and Canada. He analyzed financial, operational and sales functions of those businesses, identifying strengths and deficiencies.

This consulting service became a two-time Inc. 500 winner, became a $100 million company by selling $20,000 consulting jobs to thousands of small businesses across America. Helped more than 175,000 small and medium-size businesses.

- Transform Your Business from a Cash-Eating Monster to a 7-8 Figure-Making Machine mksmasterkeycoaching.com · testimonial · testimonials[TESTIMONIALS] – Are You Looking for Solutions that Turn Your …

Kissinger’s Business and Legal Education

University of San Francisco–Business, English and Leadership – Bachelor’s Degree

University of San Francisco Law School– Law – Juris Doctorate Degree

Golden Gate University Law School– Law and Trial Practice Certificate

San Francisco State University– Construction Business and Leadership Certificate

Nightingale Conant Corporation – Self Education

Ignite Your Business with Proven, Confidential, and 100% Guaranteed Strategies to Boost Your Growth and Profit

Don’t let another year go by, wondering, “What if?” It’s time to stop spinning your wheels and start building the business you’ve always dreamed of.

Start your journey towards becoming a dominant force in your industry. Your future clients are waiting. Your empire awaits. Are you ready to ignite it?

As your business coach, we will play a critical role in helping you make better decisions, navigate challenges, and achieve lasting success. We’ll guide your business toward sustainable growth by focusing on leadership, strategy, and accountability. Whether you are scaling up or looking for more efficient ways to operate, we’ll help them stay on track and focused on what really matters

Get in touch with us if you would like to do business together.

Review our free LinkedIn. articles. If you’ve enjoyed the content join us for FREE coffee session to discuss how we can solve your problems RISK FREE.

We are committed to your success and back up our desire to see you succeed with a 100% Satisfaction Guarantee.

When a client joins and completes any 12-month coaching program, creates an initial strategic plan with a Reitenbach-Kissinger Institute coach, and follows and implements all of the strategies, tactics and work agreed upon during the coaching meetings, said client will realize a minimum 3X ROI (Return on investment) on the coaching program they chose.

If at the end of one year that ROI is not realized, Reitenbach-Kissinger Institute agrees to continue coaching said client for free until the ROI is met.

Like joining a gym, results can only be guaranteed if the client does the work, puts in the time and communicates with their coach on a regular basis.

LET’S CHAT

Email: mjkkissinger@yahoo.com

Phone: 650-515-7545

Linkedin: https://www.linkedin.com/in/michael-kissinger-a66b214/

Website: https://www. https://mksmasterkeycoaching.com/

DISCLAIMER: This information is for informational purposes only and and does not create a professional-client relationship. Use at your own risk. The information we are sharing does not constitute legal, business, financial or investment advice and is for educational or informational purposes only. This should not be construed as legal, business, financial, investment or other professional advice in the absence of a written-executed-signed agreement.

Reitenbach-Kissinger Institute is doing its best to ensure the accuracy of the content that is published, cannot provide a guarantee for it and, thus, cannot be held responsible for incorrect information and the consequences that could arise from acting upon it.

Reitenbach-Kissinger Institute is and cannot be held liable for this advice, or legal or financial or investment advice or decisions that you make as a result of consuming our content.

Reitenbach-Kissinger Institute assumes “no responsibility” for damages that could arise from someone consuming our content on this website or following links to third-party websites that you share.

“All Rights Reserved” or “Some Rights Reserved: The content and materials are the property of Reitenbach-Kissinger Institute and should not be reproduced without its written authorization.